Follow

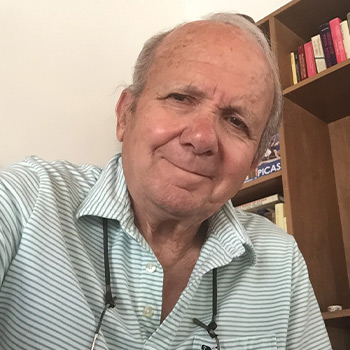

About George

George Dagnino, PhD, is chairman of Peter Dag Strategic Money Management. As the former chief economist and risk manager for Goodyear, he managed $4 billion of interest rates and currency hedge portfolios. Dr. Dagnino's unique and successful approach to managing risk was featured in an article by The Economist Intelligence Unit (London). He is also editor of the investment advisory The Peter Dag Portfolio Strategy and Management, which has been placed on the Forbes "Honor Roll" for its ten-year performance.

George's Articles

The long-term outlook remains cautious. Manufacturing is in a recession. The worrisome decline in deposits and the contraction of the money supply are saying the market is still facing massive difficulties, opines George Dagnino of Peter Dag Strategic Money Management.

The long-term outlook for the stock market remains cautious. The business cycle is in phase 4. This is the time when earnings decline. But bonds and gold remain attractive, which is why I just invested 2% of the model portfolio in the SPDR Gold Shares ETF (GLD), says George Dagnino of Peter Dag Strategic Money Management.

The stock market will remain weak to reflect slower economic conditions, lower profits, tight monetary trends, and a severe lack of liquidity as reflected by the decline in monetary aggregates and bank deposits. But I still find bonds and gold attractive, explains George Dagnino of Peter Dag Strategic Money Management.

The long-term outlook is cautious, making this is a good time to be spectators rather than aggressive investors, explains George Dagnino of Peter Dag Strategic Money Management.

George's Books

Newsletter Contributions

The Peter Dag Portfolio

Exclusive tools, time tested money management and investment strategies you won't find anywhere else. More than 25 years of successful money management experien

Learn More