The long-term outlook is cautious, making this is a good time to be spectators rather than aggressive investors, explains George Dagnino of Peter Dag Strategic Money Management.

Consider this: Economic and financial conditions suddenly improved beginning last October. The main reason? Government spending increased again last summer – The Inflation Reduction Act.

The Chicago Fed reported that financial conditions began easing around that time despite the tightening policy heralded by the Federal Reserve. The stock market bottomed. Pending home sales soared despite high mortgage rates and low affordability index. Personal income and spending improved.

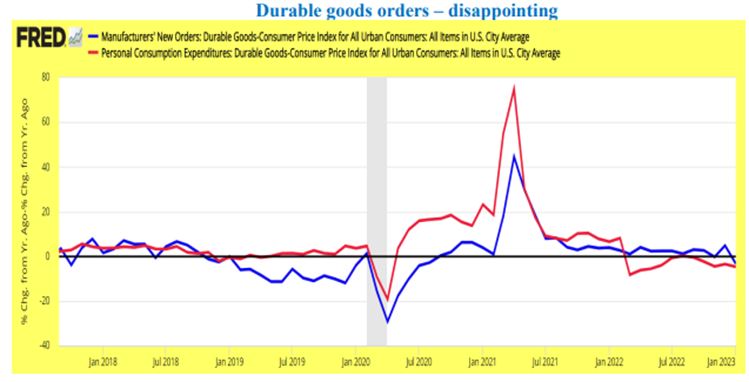

But this is where the good news ends. Durable goods orders declined -4.5% m/m and down -3.4% y/y after inflation. Consumer spending for big ticket items declined sharply: -4.8% y/y after inflation. Purchasing managers at the national and regional level report manufacturing is contracting.

Indeed, the inventory correction we anticipated is in full force and will continue to place downward pressure on economic growth. Meanwhile, government spending and Fed tightening are fighting each other with opposite policies. What a way to run the country!

As for the yield curve, a steepening is what happens when markets anticipate easing credit conditions by banks. This is not what is happening now. Plus, the trend of the market is up but trading volume is low. Volume soars at major bottoms. Not now.

That’s why we recently bought 3% of the iShares 1-3 Year Treasury Bond ETF (SHY). Bonds and gold remain attractive here, while our strategic equity model is defensive.

Recommended Action: Buy SHY.