Follow

About James

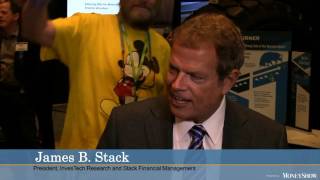

James Stack owns InvesTech Research and is president of Stack Financial Management. He has been a popular speaker at MoneyShow conferences for more than 35 years. Mr. Stack has cultivated a deep understanding of stock market cycles and developed a unique approach to risk management that makes him one of America's most respected investment advisors. Based on his extraordinary insight into the financial markets and the Federal Reserve, he has been featured in Barron's, Money Magazine, The Wall Street Journal, The New York Times, U.S. News & World Report, USA Today, and many other publications.

James's Articles

Wall Street loves to portray Presidential election years as positive for the stock market — yet the truth is, the stock market can be unpredictable surrounding elections, explains Jim Stack, money manager, market historian, and editor of InvesTech Research.

Recently, hype and headlines have been focused on the stock market reaching new all-time highs. This warrants at least a brief review of the last two years, suggests Jim Stack, a "safety-first" money manager and editor of InvesTech Research.

Evidence is showing that the U.S. economy is slowing, the tight labor market is easing, and inflation just might have softened enough to avoid another rate hike from the Fed; consequently, the vocal proponents of a “Soft Landing” are coming out of the woodwork, asserts Jim Stack, editor of InvesTech Research.

Despite the universally negative macroeconomic evidence, the stock market has seen surprisingly positive technical developments recently that are worth careful consideration, observes Jim Stack, money manager and editor of InvesTech Research.

James's Videos

Jim Stack discusses his key principles of risk management. Why cash is a position that you should have an allocation to.

At MoneyShow Las Vegas, James Stack: Inflation is very difficult to control once it starts. The Fed could find themselves raising rates more than twice.

At MoneyShow Las Vegas, James Stack It's a very expensive market, a very long bull market. We're starting to see incremental pressures develop that can bring about the end of the bull market.

"The good news is that bull markets don't die from old age," says the president of InvesTech Research and Stack Financial Management. Warning flags?