Follow

About Terry

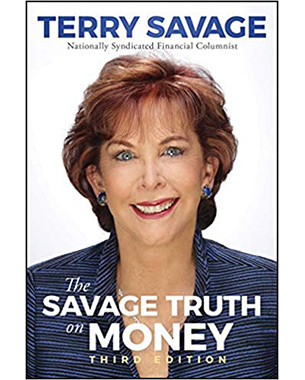

Terry Savage is a nationally recognized expert on personal finance, the economy, and the markets. She writes a weekly personal finance column syndicated in major newspapers by Tribune Content Agency. Ms. Savage is the author of four best-selling books on personal finance, including The Savage Truth on Money and The Savage Number: How Much Money Do You Really Need to Retire? She is a founding member--and the first woman trader--on the Chicago Board Options Exchange.

Terry's Books

Terry Savage

The Savage Truth

The Savage Truths on Money are time-tested, but new technologies and techniques make it easier and more profitable to make your money work for you! Now, financial success can be achieved simply and automatically through new apps, tools, and access to low-cost money management tools and advice. Living in financial security—not constantly worrying about education costs, medical bills, or having enough money saved for retirement—is within anyone’s reach.