MARKETS, STOCKS

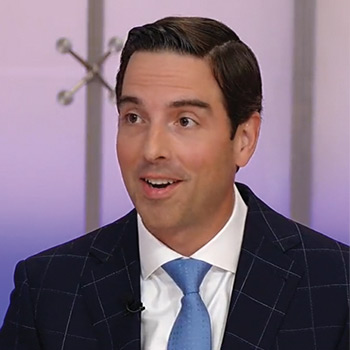

Thomas Hayes

Founder, Chairman, and Managing Member,

Great Hill Capital, LLC

- Founder, Chairman, and Managing Member of Great Hills Capital, LLC

- Hedge Funds Tips with Tom Hayes VideoCast and Podcast

- Featured on Fox Business TV, Yahoo! Finance TV, Wall Street Journal, Barron's, and More

Follow

About Thomas

Thomas J. Hayes is the founder, chairman, and managing member of Great Hill Capital, LLC (a long/short equity manager based in New York City). Before starting his own firm, Mr. Hayes worked with Cornwall Capital, LP (one of the firms featured in The Big Short book and movie). On a weekly basis, he publishes his timely stock market commentary, Hedge Fund Tips with Tom Hayes videocast and podcast. He has a wide following in the investment management, hedge fund, and media community.

Thomas's Articles

One of our highest-conviction ideas heading into 2026 is PayPal Holdings Inc. (PYPL), the world’s largest two-sided payments network with more than 438 million active accounts. While the price action implies permanent impairment, the fundamentals tell a very different story, notes Tom Hayes, editor of HedgeFundTips.

Generac Holdings Inc. (GNRC) delivered a softer-than-expected third quarter, with revenue of $1.11 billion, down 5% year-over-year and missing estimates by about $79 million. On the surface the numbers look ugly, but the story is far less dramatic than the headlines suggest, writes Tom Hayes, editor of HedgeFundTips.

GXO Logistics Inc. (GXO) just reported another standout quarter, hitting its stride in the early innings of the logistics upcycle. The mega-trends across its verticals, combined with the added complexity of tariffs and reshoring, put GXO at the center of a massive, needle-moving opportunity, notes Thomas Hayes, editor of HedgeFundTips.

When Uncle Sam becomes your business partner, good things tend to happen. That’s exactly what we saw in Intel Corp.’s (INTC) first report with Washington riding shotgun, writes Thomas Hayes, editor of HedgeFundTips.

Thomas's Videos

Join Thomas Hayes to see how we are positioned to navigate the markets for the 2nd half of 2024.

Join Thomas Hayes to hear his three turnaround stocks and the market outlook for 2024.

Join Thomas Hayes as he explains how to clean up what has been left behind. He will share the companies, sectors, and counties we are eying for alpha.

A radical change in central bank policy in the last 18 months coupled with the return of inflation have re-energized the market for long-short investing strategies. For much of the previous decade, near-zero-interest rate policies lured investors toward long-duration assets like tech stocks and long-term bonds The upshot is that long-short funds are finding new opportunities while traditional investors struggle to adjust to the new environment. Hear from several managers who are capitalizing on the changing landscape.

CFP Board Pending/1 Hour I&WI CE Credits