Tom Essaye

Sevens Report

About Tom

Tom Essaye is president of the Sevens Report, which he founded in 2012 with a singular mission: To combat the information overload facing financial professionals and provide research that helps them become more efficient and effective. The company began with a single product, The Sevents Report. This is a daily economic report that covers essential market information for stocks, bonds, currencies, commodities, and economic data. Since 2012, the firm has expanded its research offerings to provide a comprehensive research solution for today's financial professionals. The firm now also offers an investment idea-focused product, Sevens Report Alpha, a client communication solution, Sevens Report Quarterly Letter, and a chart-based product, Sevens Report Technicals.

Mr. Essaye has earned a national reputation for his straight-forward, plain-English, and accurate market analysis. He has been a frequent guest on CNBC, Fox Business, Bloomberg, and Yahoo Finance and is widely quoted in the Wall Street Journal, Barron's, Morningstar, New York Times, USA Today, Marketwatch, Axios, NASDAQ, and Bloomberg. Tom is a graduate of Vanderbilt University and has an MBA from the University of Florida.

Tom's Articles

Tom's Videos

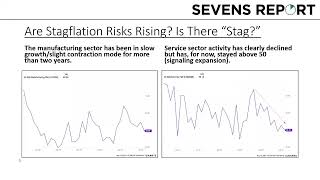

The presentation will examine the current state of economic growth and inflation to see if long-feared stagflation is making a return. More importantly, however, we will analyze what that could mean for markets, including which sectors, factors and strategies would be expected to outperform and underperform. That way, we know whether stagflation is a legitimate risk for investors and, more importantly, how to protect portfolios and outperform.