About Adams Financial Concepts

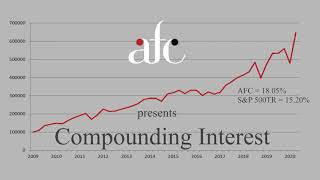

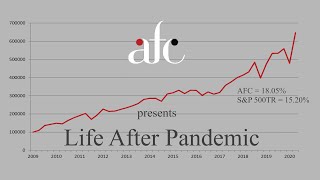

Mike Adams and the team at Adams Financial Concepts are passionate to create and maintain wealth for our clients. While past performance is no guarantee of future results, AFC has built an enviable track record over the longer-term which few money managers can duplicate. AFC believes the Incentive Profit Sharing Account is a conservative approach that builds superior returns while mitigating risk. The profit sharing aspect means that AFC does not get paid unless the client makes money. AFC seeks clients who do not accept average or mediocre performance, but clients who want to win. We seek clients who believe that their manager should be able to, over the longer-term, beat the market.

OnDemand Videos

Adams Financial Concepts's Articles

This bull market has been running for 12 years. How much longer can it run, asks Mike Adams, president and principal, Adams Financial Concepts, LLC?

Sponsored Content - Chinese stocks are tumbling and may take a long time to recover, says Mike Adams, president and principal, Adams Financial Concepts, LLC?

Sponsored Content - What is the most critical part for the manufacture of an aircraft like the Boeing 777, asks Mike Adams, president and principal, Adams Financial Concepts, LLC?

Sponsored Content - Archegos, a $10 billion fund, may have lost $100 billion. The final number is not yet settled and may not be for several months, but the loss is huge and it all seems to have happened within 48 hours, says Mike Adams, president and principal, Adams Financial Concepts, LLC.