Articles on Trading Strategies

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TECHNICAL ANALYSIS

TRADING

TECHNICAL ANALYSIS

Experts on Trading Strategies

Virtual Expos

Virtual Learning

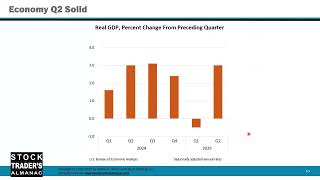

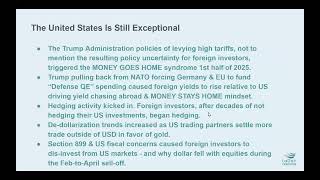

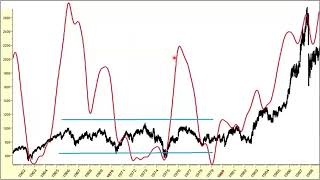

Falling realized and implied volatility levels have helped the market quickly recover from the Spring Tariff Tantrum. However, we observed similar price action in 2018 during the first trade war, followed by a period of significantly higher volatility levels, as economic data began to sour and tariffs started to take effect. We could consider a repeat, given that tariff levels today are significantly higher than they were in the past.

TRADING

The summer rally is losing steam just as August and September—the market’s historically weakest months—come into view. With inflation pressures mounting, tariffs returning to the headlines, and political uncertainty rising, timing is everything. Join Jeff as he breaks down his critical NASDAQ Best 8 Months MACD Seasonal Sell Signal, what it means for your portfolio now, and how he's adapting to the shifting landscape of rates, politics, and seasonality. Don’t miss his top picks, defensive plays, and tactical ETF moves to ride out the late-summer volatility and position for a stronger Q4.

TRADING

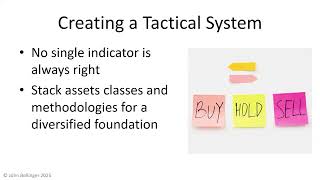

John and Zoe will examine how to strategically create portfolios that deliver returns with reduced volatility. Traditional wisdom about buy and hold strategies fails to consider that many investors are not comfortable sitting through full market cycles, especially when drawdowns exceed 20%. Through an exploration of how to combine complementary strategies and respond tactically to market activity, John and Zoe will demonstrate some of the alternatives to a pure indexing approach.

TECHNICAL ANALYSIS

Policies dictate price—so the direction of the US dollar, yields, oil, and gold can be tied closely to macroeconomic policies and global events. Samantha LaDuc, founder of LaDucTrading.com, will discuss her macro-to-micro market calls across each critical asset class and how it impacts equity market returns moving forward.

TRADING

IBD’s MarketDiem newsletter gives you hand-picked trade ideas for stocks and options right in your inbox every weekday during market hours. Our team does the research, so you get smarter trading insights, timely market analysis, and even bite-size investing lessons––all in a quick 5-minute read. Subscribe today for $4.99 per month or just $20 for the entire year.

TRADING TOOLS

TRADING

In this 30-minute session, discover how to turn both bull and bear markets into opportunities for massive growth, without shorting. You’ll learn a proven methodology that has been tested to grow your portfolio at up to 10 times the return of the S&P 500 over a 25-year test period. Learn to ignore the noise by mastering a versatile trading strategy based on rules and discipline. You’ll also learn precise, actionable insights on what to buy, when to buy, and when to secure profits, empowering you to navigate any market condition confidently. Get ready to transform market dips into wealth-building opportunities and outperform traditional investing with a game-changing system designed for consistent capital growth.

TRADING

IBD’s MarketDiem newsletter gives you hand-picked trade ideas for stocks and options right in your inbox every weekday during market hours. Our team does the research, so you get smarter trading insights, timely market analysis, and even bite-size investing lessons––all in a quick 5-minute read. Subscribe today for $4.99 per month or just $20 for the entire year.

TRADING TOOLS

TRADING TOOLS

Face-to-Face Conferences

Conferences

In today’s uncertain and computer-driven market, lots of traders are making one critical mistake. They don’t know how to manage a trade once they are in it, so they hold and watch a winner become a loser. Learn how to line up a successful trade, set a realistic target, and know when a trade is not going to work out, so you can exit before incurring large losses.

Trading requires a disciplined approach and there are techniques you can learn to use now that can minimize your risk and increase your profits. The secret lies in knowing how consistently profitable traders find trades and manage them well from start to finish. Anyone can learn these trading strategies—all you need is a commitment to discover what works and the confidence to implement them. Whether you trade stocks, options, or futures, we’ve gathered the top experts here to show you specific tactics that can be used immediately to spot opportunities and trade them profitably.

Trading is a dynamic enterprise. If you aren’t improving your systems, strategies, and technology you may be losing ground. Our experts will keep you up to date on all the cutting-edge tools—as well as some that have stood the test of time—to keep you on the fast track to trading success.

Whether you're just starting out or a veteran trader looking for fresh ideas, or you are interested in learning day trading strategies, stock trading strategies, and everything in between, this section is made for you.Every article, video, or event is designed to bring you the latest intelligence available so that you can make better trading decisions, starting with your very next trade. Our experts will help you gain the edge you need to succeed in any market environment.