Bernie Schaeffer is an industry leading options expert. Here, the editor of Schaeffer's Option Advisor looks at one bullish idea in the home entertainment space and a bearish idea in the cybersecurity market.

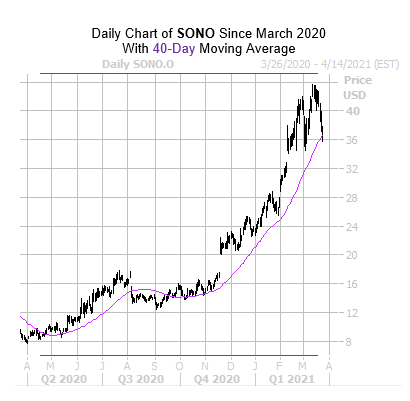

Electronics name Sonos (SONO) recently pulled back to its 40-day moving average, which coincides roughly with the same area as its mid-February post-earnings bull gap.

This region happens also is home to the shares' round 300% year-over-year level as well as just above the round 50% year-to-date level. With these long and short-term trendlines in place, there's reason to believe SONO can bounce in the coming months.

Analysts still aren’t convinced, however. Of the seven covering SONO, three consider it a "hold," presenting some upgrade opportunities if the equity continues to climb.

Meanwhile, short interest still makes up 6.7% of the stock's available float and more covering could ensue with many of the current shorts in the red.

The good news for options traders is the security's SVI of 54% sits in the 3rd percentile of all other annual readings, meaning options traders are pricing in relatively low volatility expectations at the moment.

And lastly, SONO's SVS sits up at 78 out of 100, indicating the security has exceeded volatility expectations during the past year — a boon for premium buyers.

RECOMMENDATION: Buy the July 16, 2021 35-strike call.

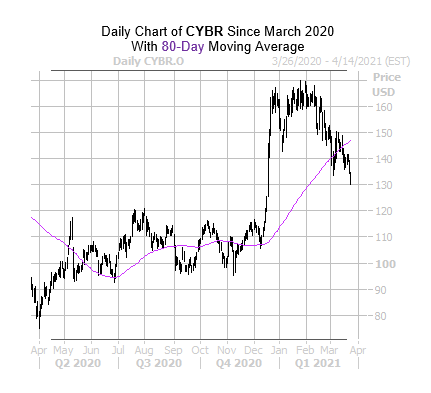

Cyberark Software (CYBR), a security solution name, has seen downward momentum with the stock breaking below several key levels of late, including the $144 region — which is double its March 2020 closing low — and its formerly supportive 80-day moving average.

The $138 level, which is home to the equity’s 2019 monthly closing high, was also recently breached, racking up CYBR's year-to-date deficit to 19%.

All this negative price action could spook momentum investors, though it looks like analysts are still on board. Of the 17 in coverage, just three consider Cyberark stock a "hold," which could invite bear notes from the brokerage bunch down the line.

Meanwhile, short sellers have been building their positions since mid-February, with short interest up 28.5% in this time frame. These bears could continue to pile on as the stock flounders, too.

The good news is CYBR puts are quite affordable at the moment. This is per the security’s SVI of 41%, which stands higher than just 11% of readings from the past year. In other words, option traders are pricing in low volatility expectations for CYBR right now.

RECOMMENDATION: Buy the May 21, 2021 140-strike put.