Last week brought a wave of rotation—after strong initial gains, the Nasdaq reversed. So, our advice is changing, right? No, not really. It’s really a stock-by-stock and portfolio-by-portfolio situation as we dive headfirst into earnings season, and one name I like is Martin Marietta Materials (MLM), writes Mike Cintolo, editor of Cabot Top Ten Trader.

In the near term, we’re half-expecting some more selling in the Nasdaq and some of the tech leaders—sentiment has gotten a bit giddy near term, which you can tell in a variety of ways (some of the weekly surveys, the fact that some speculative junk started to rally, etc.). Last Thursday’s action was something of a shot across the bow. All in all, after two-plus months up, we could be nearing the point where the leaders pull in for more than just a day or two.

You want to honor stops, and don’t forget to book some partial profits here and there (which both puts profits in your pocket and also allows you to give the remaining portion some more leeway). And, of course, if you’re top-heavy in mega-cap, Nasdaq stuff, you may want to lighten up a bit.

But there’s still been very little in the way of abnormal action, and much of the market looks just fine. Moreover, as we’ve written the past few weeks, we’re placing more emphasis on the bigger picture, which continues to look very bullish.

All told, we’re not against doing some pruning after the recent run, and on the buy side, being a bit more discerning makes sense (looking for some deeper pullbacks and not plowing in ahead of earnings, etc.) given the possibility of some more near-term potholes.

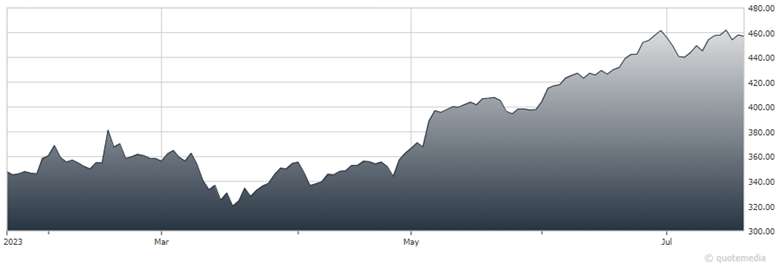

Martin Marietta (MLM)

But with the vast majority of intermediate- and longer-term evidence positive, we’re still leaning into the bullish case. Our Market Monitor remains at level 8.

As for MLM, it had a very strong breakout in early May and ran to new highs above 460 before bobbing and weaving the past three weeks. Earnings are due Thursday, but any dip into the 440 area should be a solid risk/reward situation, with a stop under the 50-day line (currently near 430).

Recommended Action: Buy MLM.