NextEra Energy (NEE) has the fastest-growing utility payout on the planet. NEE has raised its dividend by 183% over the past decade. And we dividend-magnet students know how this story goes: Over time, rising payouts drag their stock prices higher, says Brett Owens, editor of Hidden Yields.

Already, over the last 10 years, NEE has delivered 344% total returns (including dividends). It trounced the XLU sector ETF, which returned 137% over the same period.

NEE also runs a better business than the average utility. Its NextEra Energy division is one of the world’s biggest renewable-power investors, with 67 gigawatts in operation. Meanwhile, NEE operates the regulated utility Florida Power and Light. It is big in solar, which is now the cheapest form of energy in Florida.

Yet NEE’s stock price is languishing near two-year lows. The reason? Interest rate increases that are largely in the rearview mirror.

Meanwhile, Chief Financial Officer Kirk Crews is a dividend hero of mine because he’s the fastest pay raiser in the utility space. Kirk “calls his shots” too in terms of how much more money he’s going to hand out in the years ahead.

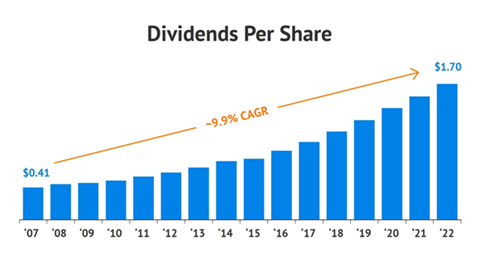

Our dividend man recently said he expects NEE to pay out 10% more per year through at least 2024. That’s consistent with the utility’s last 15 years of dividend growth, which have been (to use a technical term) terrific.

NEE investors have enjoyed 9.9% dividend growth per share every year since 2007:

NEE’s current yield tends to stay steady because the stock’s dividend magnet pulls its price higher. The 2.6% it paid recently is actually pretty good by historical standards. We can thank higher interest rates for the recent pullback.

We contrarians guide our portfolios by looking through the windshield rather than the rearview mirror. And the road ahead for NEE looks pretty good. When we take its current 2.6% yield and add expected 9.9% dividend growth, we see 12.5% yearly returns for the foreseeable future. Sign us up for that expected return!

Recommended Action: Buy NEE.