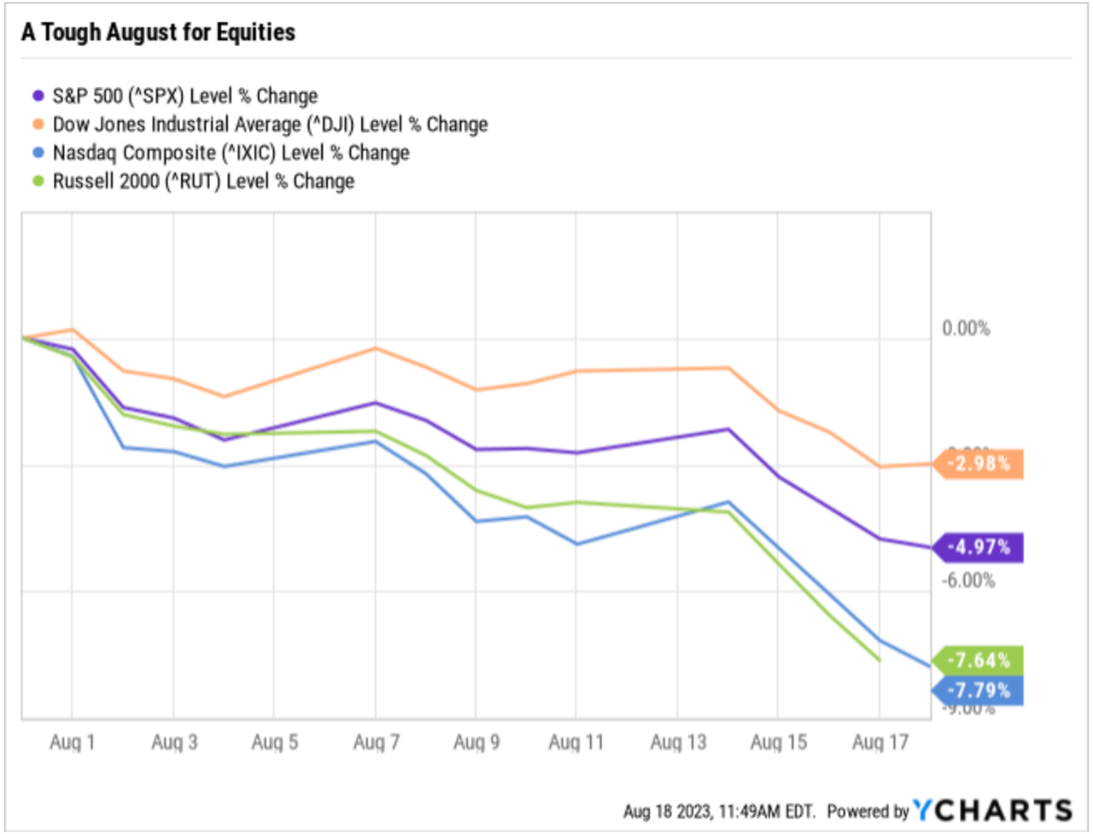

The tough August for equities has continued. It is not a pretty picture for the bulls, but hey, who said the road to recovery wouldn’t come with a few stumbles? Still, if we widen our lens a bit, we can see that stocks remain firmly higher year to date, and that the move higher has been led by the Nasdaq, up 29% year to date (YTD), opines Jim Woods, editor of Intelligence Report.

Now, what is the “reason” for the pullback here in stocks, and why are we in risk-off mode?

The short answer is a confluence of negatives such as rising bond yields, a rising US dollar, downbeat China economic data, a change in market sentiment, and the presumption of “higher-for-longer” interest rates. There’s also a lack of any obvious bullish catalysts on the horizon here, especially now that earnings season is largely over.

Now, before you descend into a bearish sense of pessimism, keep in mind that what I’ve called the “three pillars” of the current rally remain intact. Those three pillars are 1) Expectations for an economic soft landing, 2) Continued disinflation, and 3) The Fed being done (or nearly done) with interest rate hikes.

Until one or more of these three pillars falter, the rally will likely remain intact, although there will likely be more churn and more give and take between bears and bulls.

The real question here is what can reignite the rally and help push stocks out of this August funk? The way I see it, there are four candidates, or what I’m calling the “Big 4” bullish catalyst candidates:

Candidate One: Treasury yields declining modestly. We don’t want Treasury yields to collapse, as that’d signal a hard economic landing. But a drift lower, especially in the 10-year Treasury Note, would help support the market multiple and make the argument for a 20X valuation (up from the current 19X) more viable.

Candidate Two: Better-than-expected earnings. If multiple expansion is basically exhausted, then it’s up to increased earnings to push stocks higher. Current 2024 S&P 500 earnings per share (EPS) expectations are about $240. If corporate commentary pushes that number to $250 (or even slightly higher) that makes 4,750 (which is earnings of $250/share times a 19X multiple) a legitimate target.

Candidate Three: A change in sentiment. Negative sentiment is the unsung hero of the 2023 rally, as negative expectations never materialized, leaving most money managers to chase stocks higher. Now, it’s flipped, where higher stock prices are the consensus expectation. If the market stalls, or modestly pulls back, then sentiment can become more negative and give us that perception gap that can lead to a rally.

Candidate Four: Surprise good macro news. An improvement in the United States-China relationship, large-scale Chinese economic stimulus or a ceasefire in the Russia-Ukraine war would all provide a surprise boost and reduce global recession chances, and that would help lift stocks. Now, I am not saying that these are likely outcomes. However, a surprise on this front would help reignite the pre-August rally.

The bottom line here is that while August has been a downer, the three pillars of this wider rally remain intact, and there are four bullish candidates looming that could reverse the current month’s action. So, the prescription for your money here is…stay the course and remain patient.