The attention of most investors, commentators, and analysts has been on the winners, notably the Magnificent Seven, driving this year’s stock market rally. But of course, there are 493 other stocks in the S&P 500 and hundreds of other large-cap and mid-cap stocks not in this famous index. One potential turnaround play I like is Wolverine World Wide (WWW), writes Bruce Kaser, editor of Cabot Turnaround Letter.

As contrarians, we are fine with letting a few overpriced trendy stocks capture the spotlight. Sooner or later, most of these glamour stocks will fade, or worse.

One place that draws our attention is the other end of the spectrum – those with the worst performance. Most of the companies behind these rejected stocks fully deserve the market’s dour judgment. Some, however, have changes underway that could restore their prosperity and return their shares to investors’ favor.

Take Wolverine. It is a major producer of widely recognized shoes, boots, and related apparel including Merrell, Saucony, Wolverine, Bates, Sperry, and Sweaty Betty. After riding the pandemic surge in outdoor gear, Wolverine’s revenues and profits are sliding.

Lower wholesaler and consumer demand, along with higher discounting (to remove an inventory glut) and elevated input costs, are pressuring the company’s prospects. The $417 million all-cash acquisition of Sweaty Betty in 2021 added new weight to the over-leveraged balance sheet.

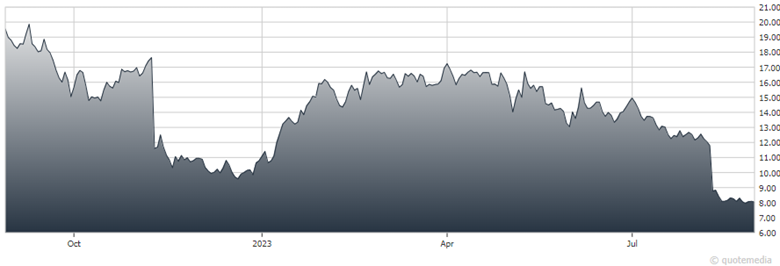

Wolverine World Wide (WWW)

In response, investors have unloaded the company’s shares, which have tumbled 80% from an all-time high to near their global financial crisis low. To help right the ship, earlier this month Wolverine abruptly replaced its CEO with its well-regarded president and head of the Active (sports) segment.

In addition, the board has been refreshing its management, replacing the leadership of several segments, and narrowing its product focus while raising cash. Wolverine is offloading many of its iconic leisure brands (including Sperry and Keds) as well as unnecessary real estate to concentrate on its core Work and Active boots and shoes, along with Sweaty Betty.

While the balance sheet is levered at 3x year-end estimated EBITDA, most of the debt is at fixed interest rates and the nearest major maturity is in 2026, providing some financial flexibility for the turnaround. Wolverine also generates positive free cash flow, and the shares trade at a reasonable 7.0x estimated 2024 EBITDA and a modest 5.3x per-share earnings. While a successful march to a more prosperous Wolverine isn’t guaranteed, the shares of this shoe and boot maker may be a good fit.

Recommended Action: Buy WWW