Stocks ripped into the close yesterday, regaining essentially all of the “Jay Powell Surprise” selloff from Wednesday. We’ll see what happens today, though, after shocking jobs data. Meanwhile, Treasuries, gold, silver, and crude oil are down, while the dollar is up.

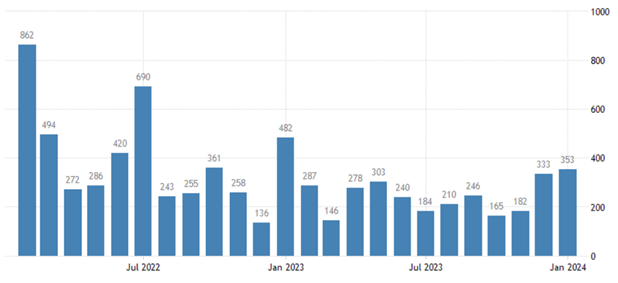

Talk about a shocker on the jobs front! The Labor Department reported that the US economy created 353,000 jobs last month, almost double the average forecast of 180,000. The unemployment rate held at 3.7% rather than ticking up to 3.8% as expected, and average hourly earnings growth hit 0.6%. That was double the 0.3% forecast. Needless to say, this further reduces the chance of a Federal Reserve rate cut in March.

Nonfarm Payrolls Monthly Change (1,000s)

Source: TradingEconomics.com

Big Tech. Big Oil. It’s a big earnings extravaganza to close out the week.

Starting with technology, both Meta Platforms (META) and Amazon (AMZN) topped analyst estimates in the most recent quarter. Meta said sales jumped 25% while profits tripled, helped in part by a wave of job cuts, better advertising sales, and increased video watch time. The social media giant also launched a $50 billion stock buyback and announced its first-ever quarterly dividend. Shares soared on the news.

As for Amazon, revenue climbed 14% to $170 billion in Q4, helped along by a 9% rise in online sales during the holiday season. Operating profit beat forecasts by a wide margin, boosted by layoffs that hit 35,000 last year. Finally, sales growth at the company’s Amazon Web Services cloud computing division accelerated slightly to 13%. All of that news cheered investors, sending the stock up sharply in early trading.

Apple (AAPL) was really the only disappointment in the industry. While earnings per share and revenue beat forecasts in Q4, Chinese iPhone sales missed expectations and iPad and Mac revenue overall came in light. Apple also warned of weaker current-quarter iPhone sales in China. AAPL shares are modestly lower on the news.

In the energy sector, Exxon Mobil (XOM) earned $7.6 billion in Q4 profit, while Chevron (CVX) earned $2.3 billion, helped by strong production figures. While impressive, profits were down notably from a year ago due in part to hefty impairment charges and lower crude oil prices.