Stocks were strong yesterday, then weak heading into this morning’s key employment report February. But they rallied in its wake. The dollar slipped, gold and silver climbed, and Treasuries were mixed.

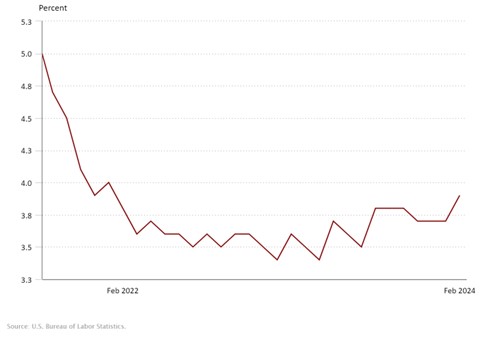

So, what did the data show? Total employment rose by 275,000, topping the average forecast of 200,000. But the unemployment rate popped to 3.9%, when economists were looking for it to hold steady at 3.7%. Average hourly earnings growth also dropped to 0.1%, below the 0.3% estimate.

At 3.9%, Unemployment Rate Highest Since January 2022

That’s “good” for markets because it shows the labor market is cooling without collapsing. Or in other words, it’s the kind of data that keeps the Federal Reserve on a path to lowering rates, without implying the economy is slipping into recession.

Discount grocer Aldi is looking to add 800 stores across the US over the next five years as part of a $9 billion expansion plan. It just finalized the purchase of Southeastern Grocers, which operated stores under the Winn-Dixie and Harveys Supermarket brands, and plans to convert them to its banner. Aldi will also expand in states like California, Arizona, and Nevada.

Finally, cruise ships are fuller than they’ve ever been since the pandemic and passengers are coughing up big bucks to book tickets and buy on-board extras. Yet many investors aren’t rewarding their shares much because they’re focusing on the debt the big three piled on during the pandemic. This Wall Street Journal story explains why that might provide investors an opportunity to bargain hunt.

So far this year, Norwegian Cruise Line Holdings (NCLH) is up 7%, while Royal Caribbean Cruises (RCL) is only showing a 3.5% gain and Carnival Corp. (CCL) is down 9%. The SPDR S&P 500 ETF (SPY) is up 8.3% by comparison.