The averages are flatlining today after a very interesting trading day on Tuesday. Gold is popping along with crude oil, while Treasuries and the dollar are treading water.

I’m calling it the “Out of Palantir, Into Pampers” stock market rotation. We saw a vicious move yesterday, with investors selling “Big Tech” and Artificial Intelligence (AI) leaders like Palantir Technologies Inc. (PLTR) and buying names like Pampers-manufacturer Procter & Gamble Co. (PG) that had previously lagged.

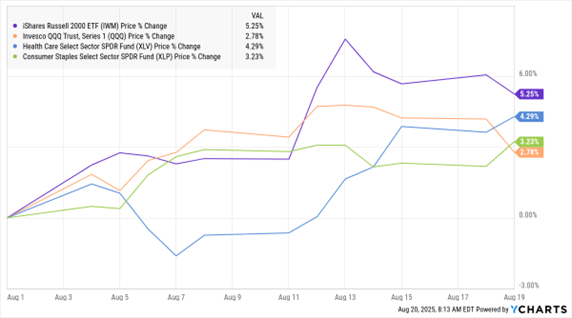

In fact, we’ve seen a more-modest rotational trend on-and-off for the last couple of weeks. Since Aug. 1, for instance, the iShares Russell 2000 ETF (IWM) has gained 5.2% -- topping the 2.7% gain for the Invesco QQQ Trust (QQQ). Sector ETFs that lagged through most of 2025, including the Consumer Staples Select Sector SPDR (XLP) and Health Care Select Sector SPDR (XLV), have also outperformed tech. They gained 3.2% and 4.2% respectively.

IWM, QQQ, XLV, XLP (Aug. 1–20 % Change)

Data by YCharts

A flood of retail sector earnings is continuing to wash over Wall Street. Target Corp. (TGT) shares fell in early trading after the general merchandise retailer reported a 1.9% drop in comparable store sales from a year ago. Margins also dipped, even as bottom-line profit slightly beat lowered forecasts.

On the flip side, shares of the home improvement giant Lowe’s Cos. (LOW) gained after it reported a 1.1% rise in same-store sales. Adjusted earnings per share beat analyst estimates by 9 cents, and the company said it would buy Foundation Building Materials for $8.8 billion. Acquring the privately held housing products distributor will bolster Lowe’s sales to professional customers and contractors.

Finally, another data center mega-project appears to be coming together in Texas. JPMorgan Chase & Co. (JPM) and Mitsubishi UFJ Financial Group Inc. (MUFG) are reportedly underwriting a $22 billion loan to finance construction of the Vantage Data Centers campus. Low electricity costs in Texas are luring data center builders, whose services are in high demand because of the AI boom.