The so-called FAANG stocks are the darlings of the tech world. But you can be forgiven for not looking to the big-name tech stocks for high dividends, asserts Michael Foster, editor of Contrarian Outlook.

Just look at this rogue’s gallery of pathetic payouts — Apple (AAPL) has a dividend yield of 0.9%, while Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL) each yield zero. They’re no place for retirees, or anyone else on the hunt for dividends.

Luckily for the folks who hold these stocks, which make up about 17% of the S&P 500, they’ve made up for their pathetic—or nonexistent—dividends in outsized price gains as the market has bounced back.

So if you’re ready to buy FAANG stocks but want to squeeze a dividend out of them, here’s how to do it.

The first option is the route most folks take: buy an ETF that specializes in FAANG. This will give you these stocks at their market price, along with some diversification.

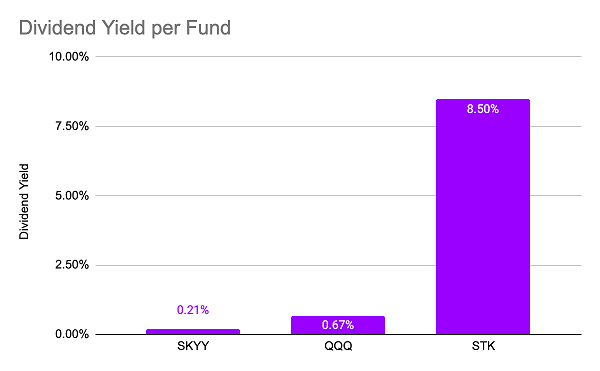

That’s great, but a tech ETF like the Invesco QQQ Trust (QQQ) or the First Trust ISE Cloud Computing Index Fund (SKYY) isn’t going to get you much income, since neither pays more than 1% in dividends.

You’d be far better off with the Columbia Seligman Premium Tech Growth Fund (STK), a tech-focused closed-end fund holding stocks from the FAANG group, such as Apple and Alphabet, as well as other essential tech plays, like Microsoft (MSFT).

Visa (V) also appears in STK’s top-10 holdings—its vast payment network makes it something of a hybrid finance/tech stock. STK pays an outsized 8.5% dividend yields. That’s 12.6 times more than you’d get from the aforementioned tech ETFs.

In fact, there is no tech-focused fund in the United States that offers a higher yield than STK. You can buy this fund, get a strong tech portfolio and hold on as STK’s market price rises — while drawing that huge 8.5% payout the whole time.