Schlumberger (SLB) is the undisputed international leader in products and services for oil & gas producers. With a market cap of $43 billion, it’s the biggest in the business, explains Genia Turanova, editor of Curzio Research's Unlimited Income.

Founded in 1926, the company employs some 82,000 people across 120 countries today. Simply put, its technology and services make exploring for oil and producing it easier and more efficient.

Schlumberger has the industry’s most comprehensive range of products and services from exploration through production — and its high-tech services are indispensable for all stages of production, from the discovery to the oil well to the pipeline. It helps customers save money in the long run by servicing almost every step of the exploration and production process.

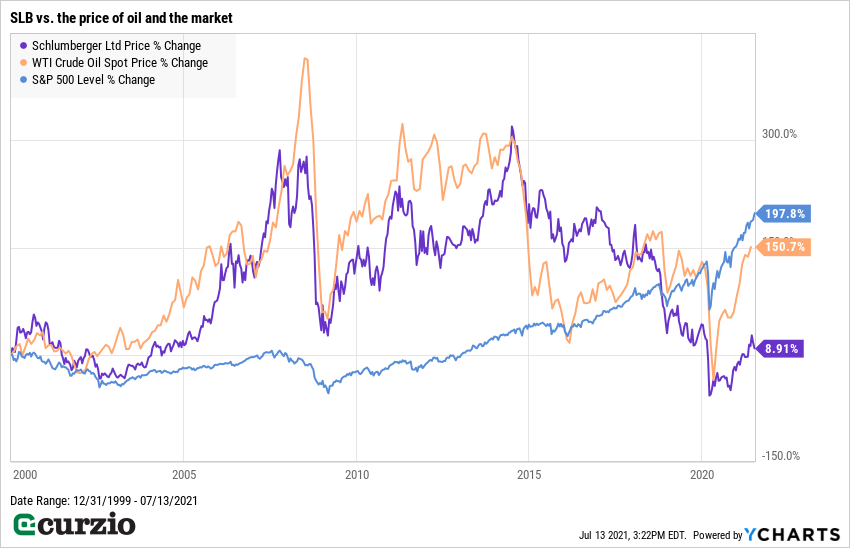

The company’s success is tied to the entire oil and gas industry. Unless its customers are in full-on preservation mode, they need Schlumberger’s services. With some exceptions, shares of SLB tend to rise and fall with the price of oil — trailing when oil is declining and outperforming when oil is rising.

This makes it an ideal way to play the ongoing oil recovery. But we can’t ignore long-term trends. Green energies, from solar to wind, are here to stay.

In fact, this trend is only expected to accelerate — creating an existential threat to the oil & gas industry. Based on the history of past sector busts, SLB no longer wants to be exposed to the extremes of the oil cycle.

And the company has a plan. Schlumberger sees a future beyond oil and gas, and wants to be a significant player in the energy transition. In the near to medium term, it’s focused on three main “green” initiatives:

1. Help reduce emissions by identifying, measuring, and eliminating the largest-impact elements.

2. Provide technologies to reduce — and even eliminate — the need for “flaring,” or burning unneeded emissions.

3. Electrify the oil and gas industry — and power production more sustainably.

Longer-term, Schlumberger is quietly working on a variety of sustainability projects. Early in 2020, the company started its New Energy business venture with a focus on energy efficiency and storage… and breakthrough technologies in green energy.

It’s a fast-growing market: $50 to $75 billion will be spent annually by the end of this decade. With a range of projects and partnerships in areas ranging from carbon capture… to geothermal energy… to hydrogen… to lithium, Schlumberger is making sure it will remain relevant for decades to come.

Two of its most interesting recent projects involve lithium — a must for electric vehicles (EVs) and other batteries, where demand is growing exponentially.

In May, Schlumberger announced a new pilot plant called NeoLith Energy. Based in Clayton Valley, Nevada, the project aims to develop a more efficient, differentiated direct lithium extraction (DLE) process.

And just a month ago, the company announced a new collaborative project with Panasonic Energy, where Schlumberger will work on a new lithium production process.

These projects might not become meaningful contributors to earnings for a while — but they guarantee Schlumberger won’t be left behind when the world moves on from fossil fuels.

Profits are growing at a mind-numbing rate. Schlumberger used to trade at a significant premium to the market. But with a forward P/E of just over 19, it currently trades at a 10% discount to the market.

That’s because of revenue and profit setbacks during the oil price weakness post-2014 and an even tougher market in 2020. More than $9 billion in lost revenue ($32.9 billion in 2019 and $23.6 billion in 2020) and a quarterly dividend cut (from $0.50 per share in 2019 to $0.125 today) were inevitable.

But the company is recovering. Analysts expect SLB to grow its profits at a mind-numbing 50% annual pace for the next couple of years as we see more demand from recovering — and growing — economies.

Meanwhile, its dividend yield stands at 1.6% — not high relative to the company’s past dividend, but affordable for the company, and better than the market’s 1.3%. Going forward, SLB will return excess cash to shareholders through either dividend or stock repurchases.

One thing is for sure: If energy prices remain strong, SLB’s business will do great. It’s the go-to oil service company for the entire industry, be it in the U.S. or internationally. And the company’s New Energy portfolio will ensure its growth continues even as demand for fossil fuel declines. Plus, as it has in the past, SLB will share its growing profits with shareholders.

Action to take: Buy a full position in SLB for a combination of price appreciation and dividend yield. Don’t pay more than $34 per share.