Sometimes, things are so obvious that you just can’t believe other investors are missing it. I believe that’s the case right now for my highest-rated pick, asserts asserts Paul Price, a daily columnist with TheStreet’s Real Money Pro.

The main business at American Woodmark (AMWD) is building kitchen cabinets and bathroom vanities. It is not a household name as it sells mainly to homebuilders and through home improvement retailers like Home Depot (HD) and Lowe’s (LOW) rather than directly to consumers.

AMWD’s long-term growth has been sensational. Since the end of FY 2012 (ended Apr. 30, 2013) every major business metric showed huge gains. If FY 2021 comes in as is now expected, EPS will have grown by over 976% in nine years.

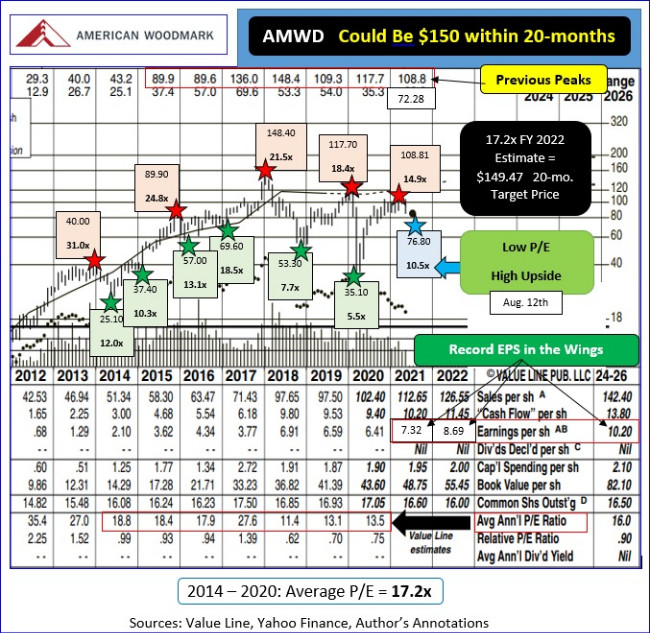

Continuous shareholders have been well rewarded yet the stock, which peaked north of $148 in early 2018, has pulled back sharply since then. AMWD hit a 52-week low of $72.28 just a few days ago. It closed on Aug. 11, 2021 at $76.80.

There is a ton of imbedded value creation in AMWD that is not currently being reflected in its stock price. Smart investors should be backing up the truck to own American Woodmark before the next inevitable run-up arbitrages away the disparity.

AMWD changed hands as high as $108.81 on Mar. 12, 2021. What made it drop so much and so quickly? Lumber prices, very critical to AMWD as its main raw material cost, briefly spiked up sharply pinching AMWD’s profit margins on already contracted for deliveries.

That hurt fiscal Q4’s results (ended Apr. 30, 2021) and tanked the shares. Recently, though, lumber futures retreated to a 9-month low. Price increases implemented to counteract surging wood prices are now in place and are likely to remain in place. That bodes very well for future results.

Analysts now see all-time record EPS for AMWD in both FY 2021 and FY 2022. If lumber futures remain tame those estimates may well prove too low.

AMWD’s typical P/E has run about 17.2x. Applying that multiple to current year’s expectations suggests the stock could be back at $126 by next spring and perhaps $150 or so by April of 2023.

Yahoo Finance conservatively holds out a $103.75 12-month goal price. That implies just an 11.9x forward P/E. Achieving even that modest goal would deliver a very acceptable 35% gain from here.

AMWD is a trader’s delight. It often suffers sharp but, short-lived sell-offs followed by much longer and much larger price rebounds. I’m betting that AMWD’s Aug. 9, 2021 nadir of $72.28 was the final turning point. The shares now show some positive momentum, having surged by $4.52 (+6.25%) in just two days.

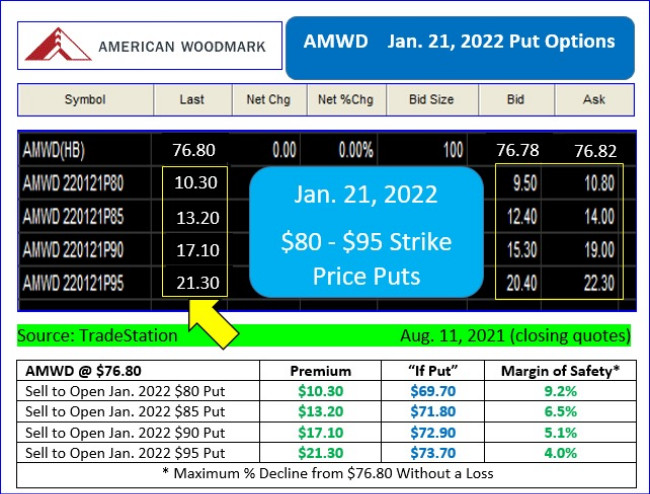

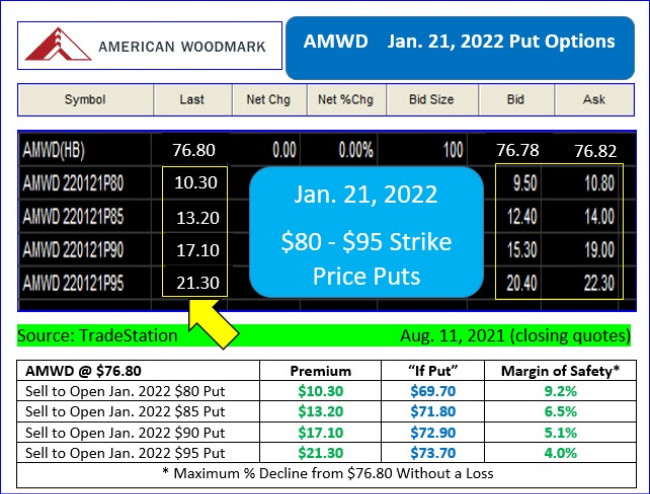

Option traders can play for a rise in AMWD via sales of in-the-money naked puts out to Jan. 21, 2022. April 2022 expirations will begin trading not later than Aug. 23rd.

Actual prices, with AMWD @ $76.80, on its $80 to $95 Jan. 21, 2022 puts are shown below. Worst-case, forced purchase prices on the $80 or $85 strikes were below AMWD’s 52-week low, set just days ago.

Margins of safety are relatively modest as few option buyers are willing to bet that American Woodmark has any downside left.

AMWD could easily double from here within 18 – 24 months. That goal is not farfetched. The shares peaked at about $136 and $148 during 2017 and 2018 on EPS of $3.77 and $6.91 respectively. Buy some AMWD shares, sell some naked puts or consider doing both.

Disclosure: Long AMWD shares, short AMWD options.