There's always a tension between the goals of having cash readily available, protecting that cash from inflation, and producing enough income from your portfolio, explains income expert Rida Morwa, editor of High Dividend Opportunities.

With inflation hitting multi-decade highs, inflation protection is even more critical. It's essential to have cash ready to pay both expected and unexpected expenses.

Holding cash also can help you take advantage of a significant price drop in the shares of a company you want to own. It's also good to have the cash already available so you don't have to sell shares when prices are low. However, cash is very exposed to inflation.

In the past, short-term bonds were an excellent place to seek inflation protection. As inflation happened, these bonds would have interest rates that provided inflation protection.

Since the term was short, if inflation increased, the short time to maturity allowed one to hold until they matured (and avoid price risk in an increasing rate environment) and quickly swap into bonds with an even higher coupon.

However, with the Federal Reserve holding the short end of the rate curve down, this strategy is less effective. So, where do we look for inflation protection? As it happens, there's a class of bonds issued by the U.S. government, specifically designed to protect investors from inflation.

What are TIPS?

This class of bonds is known as Treasury Inflation-Protected Securities or TIPS. TIPS provides inflation protection in two ways.

First, every six months the bond's face amount is changed based on changes in the CPI (Consumer Price Index). While each TIPS pays a fixed interest rate, this is applied to the adjusted amount rather than the bond's original face value. So your interest payments will increase if there is inflation and will decrease if there is net deflation.

Second, when the bonds mature, you will get back either the original face amount or the adjusted amount, whichever is greater. Both your income and principal are protected from erosion by inflation.

TIPS are available in face amounts in increments of $100. They're issued with terms of 5, 10, and 30 years. They pay interest every six months based on the adjusted amount.

Why Use a Fund to Hold TIPS?

You can buy TIPS individually (straight from the Treasury or from a bank or broker), or you can use an ETF to buy them. The major benefit of using an ETF is that you instantly get diversification and having a mix of durations. Below are two great TIPS ETFs to invest in.

iShares TIPS Bond ETF (TIP) is one ETF to consider (and one of the largest). It has a TTM yield of 3.11% (as of 8/9/21) The ETF invests in TIPS at least a year to maturity and tracks the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities index.

This fund includes longer-term TIPS that carry a higher interest rate. The current yield is attractive for parking cash, and the inflation protection from holding TIPS makes it even better.

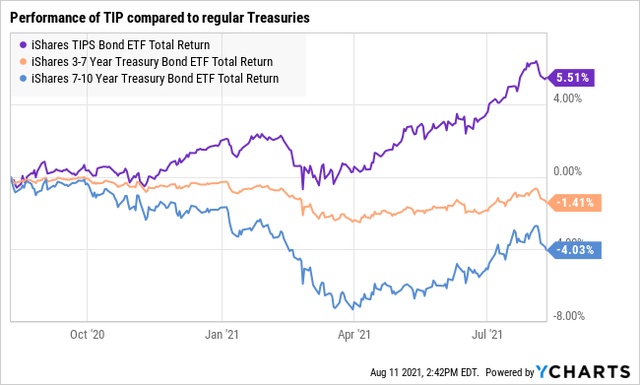

Since the beginning of the year, TIP has been outperforming regular Treasuries as inflation expectations hit the markets. TIP returned 5.5% over the past 12 months compared to negative returns for both short-term iShares Treasuries 3-7 years (IEI) and the medium-term iShares Treasuries 7-10 years (IEF).

Note that the longer-term Treasuries took a much bigger hit once higher inflation was reported.

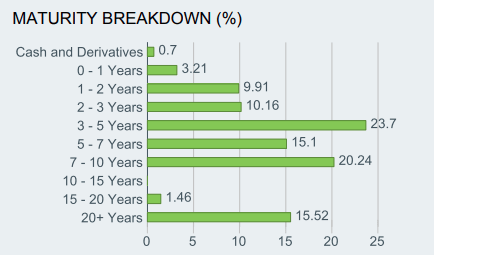

Source: TIP Fact Sheet - June 30, 2021

Looking at the maturity breakdown, TIP is structured for an intermediate horizon. With an effective duration of 7.68 years, its price should be slightly less sensitive to interest rates than the 10-year Treasury. The 15.5% at the longest end gives a nice bump to yield.

iShares 0-5 Year TIPS Bond ETF (STIP) is another TIPS fund that holds shorter duration TIPS. It also has a slightly better TTM yield than does TIP, at 3.21% (as of 8/9/21). It follows the Barclays U.S. Treasury Inflation-Protected Securities 0-5 Years Index.

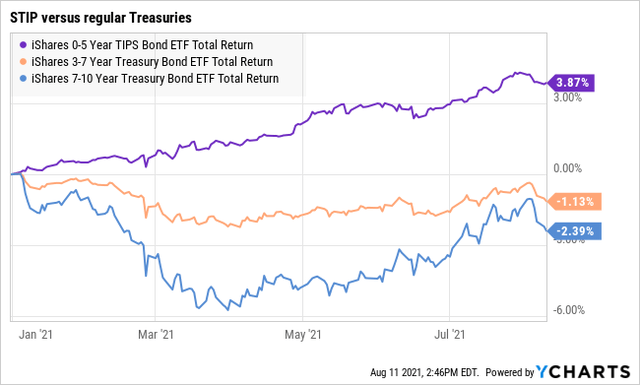

There's a trade-off in that the shorter-dated TIPS will have lower base coupon rates and are less sensitive to changes in interest rates. Like its sister ETF TIP above, it has beaten both the short-term Treasury ETF (3-7 years) and the medium-term ETF (7-10 years) by a large percentage.

Just like TIP, STIP has done better than regular Treasuries and both are more than sufficient to protect investors from inflation.

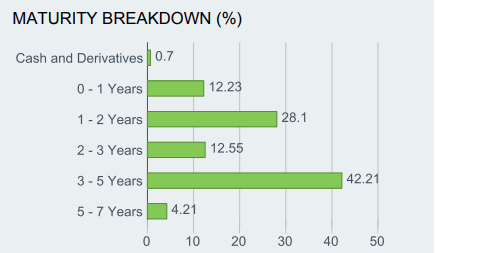

Source: STIP Fact Sheet - June 30, 2021

STIP has much shorter-term holdings. It has roughly 75% more of its portfolio in the 3-5 year range than does TIP. This should significantly reduce volatility if interest rates change.

And with the Fed holding down the short end of the rate curve, the rates on similar durations bonds should see smaller increases than the higher end of the curve as well.

With STIP's maturity average being just 2.79 years, and TIP with an average of 7.68 years, STIP has less interest rate risk and volatility.

Are TIPS a good buy now?

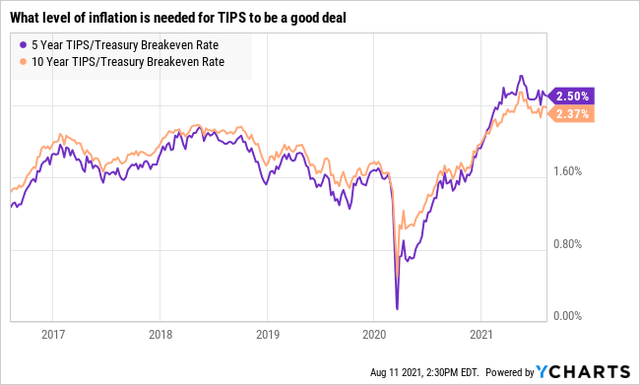

Because they offer inflation protection that ordinary Treasuries do not, TIPS trade at a premium to Treasuries with similar duration and coupon. It's fairly easy to calculate the inflation rate at which buying TIPS becomes a good deal. This is called the breakeven inflation rate.

Over the last five years, TIPS hasn't been a great deal. The breakeven point was only slightly below the actual inflation rate. But now, the breakeven inflation rate is around 2.5% (for either 10-year or five-year TIPS).

Given that the last two monthly inflation readings show inflation over 4%, this makes the current pricing of TIPS quite attractive. Remember in our example of a TIPS bond above, in just six months, TIPS had already offset 1.35% of inflation. and after nine months (August 11th) had adjusted by 4.0%

Conclusion

A lot of investors want to keep cash around for various purposes. Either in the case of a great buying opportunity or to pay expenses, both expected or unexpected. Not only do they want to be protected from having to sell assets when prices are poor, but they want protection from inflation as well.

While it will be necessary to keep some cash around, keeping more than a few months in cash risks losses from inflation. Over the next few years, we expect inflation to be biting harder than it has since the 1980s.

With the Fed sitting on short-term interest rates over the next few years, our choices of parking cash are limited. Fortunately, TIPS and TIPS funds like the ETFs TIP and STIP offer us a good place to park your cash and protect it from inflation. Inflation is in your favor by parking cash with both TIP and STIP.