The tagline of the Sure Passive Income newsletter is “rising passive income from buy & hold forever securities.” Forever is a long time. But at the very least, it can be useful to think of investing holding periods in terms of years or decades, rather than days or weeks. Automatic Data Processing (ADP) is a great example of how that approach can pay off, notes Ben Reynolds, editor of Sure Passive Income.

It’s easy to get caught up in the day-to-day share price swings. The constant news cycle implores you to think that each and every new event has a material impact on your holdings. Of course, this is unlikely to be the case.

Over time, a group of profitable businesses tends to do quite well, regardless of how much “bad news” there is out there. In that light, it can be beneficial to own great businesses, ignore the daily fluctuations, and simply “sit on your hands.”

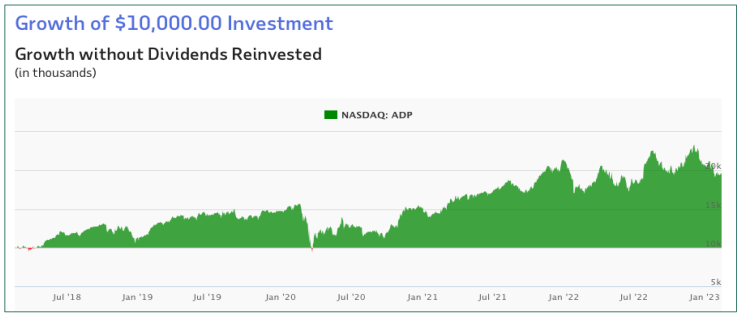

To highlight this concept, we thought it might be interesting to illustrate the performance of one of this month’s Top 10 securities over longer periods of time. Here is a look of ADP over the last five years:

There have certainly been ups and downs. But a $10,000 starting investment would now be worth over $19,000 - representing a compound annual growth rate of over 14%.

ADP is a cloud-based HR capital management solutions platform that operates globally. The company has two operating segments: Employer Services and Professional Employer Organization (PEO). The Employer Services segment offers HR outsourcing solutions, including payroll, benefits administration, talent management, workforce management, compliance services, and HCM solutions.

PEO offers similar services to small and mid-sized businesses. ADP was founded in 1949, generates almost $18 billion in annual revenue, and trades with a market cap of $93 billion. In addition, the company has a 48-year dividend increase streak.

ADP also reported second-quarter earnings on January 25th, 2023 and results were in line with expectations. Adjusted earnings-per-share was $1.96, which beat estimates by two cents. Revenue was up more than 9% from the year-ago period to $4.39 billion, meeting estimates. Adjusted EBIT was up 15% to $1.1 billion, or 24.3% of revenue. That final figure was up 120 basis points year-over-year.

Apart from the harshest recessions, ADP has seen exceptional earnings stability and growth over its history. ADP’s payout ratio is also just over 60% of earnings, so even in the event of recession, we do not believe a dividend cut would be necessary. ADP’s history of nearly half a century of dividend growth looks to be intact for many years to come.

Recommended Action: Buy ADP.