I will resist the urge to go too far down the rabbit hole of explaining the current banking “crisis” one more time. As far as the current situation goes, most Americans are safe. That means investors can continue to invest cautiously in select momentum stocks, including CPI Card Group (PMTS), recommends Tim Melvin, editor of 2023 Turnaround Project.

So far, we are about breakeven with the stocks we have. Keep in mind that from day one, we have targeted ten value and ten momentum stocks to make up the full portfolio. With nine stocks currently, we are just 45% invested.

One reason: Right now, market momentum is negative. Moreover, the monthly momentum has been negative since April 2022. Daily momentum on the Russell 2000 went negative on February 10 and has stayed negative since.

But there are still select opportunities worth considering, one of which is PMTS. PMTS is a stock showing the type of smooth up and to the right momentum I like to see, largely driven by earnings that have been growing by more than 25% annually for the past five years.

CPI Card Group makes debit cards, credit cards, prepaid cards, gift cards, and any other type of financial services card you can imagine. The company works with five of the largest credit card issuers, as well as many fintech financial service providers, credit card processors, and five of the six largest prepaid debit card providers. It also offers instant issue card services for small and medium-sized banking institutions.

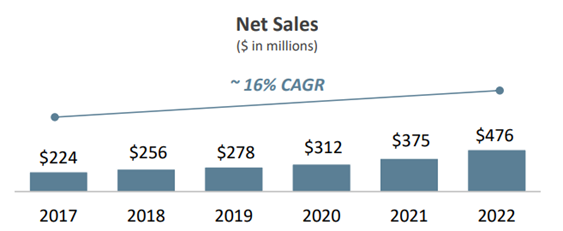

We are moving to a paperless, cashless world, which will provide enormous tailwinds for CPI Card Services. Revenues have grown 16% annually since 2017, and cash flows have compounded by more than 33% yearly.

The business and fundamental performance attract the attention of institutional investors, giving the stock the momentum I like to see. As a result, CPI Card Group is one of the few companies trading near 52-week highs right now.

Recommended Action: Buy PMTS.