Most US-based investors think primarily of US stocks when they consider stock investments. That home-country bias cost them so far in 2023 and is likely to cost them more over the next few years. Instead, consider the Japanese stock market and funds like the iShares MSCI Japan Value ETF (EWJV), suggests Bob Carlson, editor of Retirement Watch.

US stocks dominated investment returns the last couple of decades, and US growth stocks delivered far higher returns than other investments. But markets tend to “revert to the mean,” and the forces that provided advantages to US stocks in general and US growth stocks in particular are fading. Investors looking for high stock returns should consider markets outside the United States.

The major stock indexes in Japan peaked in the late 1980s and have been in a bear market since. Every time it appeared Japan’s economy and stock markets were set to recover, the rallies fizzled.

Until lately, that is.

The Nikkei 225 stock index is up more than 18% this year and recently hit a 33-year high, though it still hasn’t returned to the highs of the late 1980s.

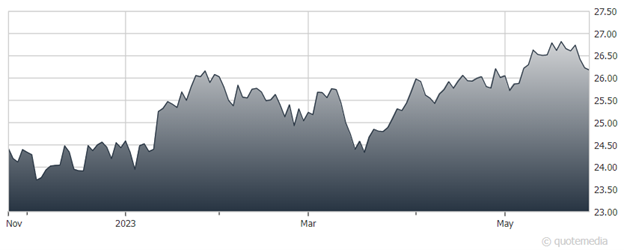

iShares MSCI Japan Value ETF (EWJV)

While Japan has its economic problems, several factors make it an attractive investment. The stocks sell at good values relative to many other markets, especially US markets. Japan’s long-term deflation and economic depression finally appear to have turned the corner.

The Bank of Japan shows little inclination to tighten its monetary policy and, in fact, seems content to keep interest rates low and let the yen decline against many other currencies. Japan’s economy seems to be in better shape than Europe’s, and the United States appears to be more at risk of an economic downturn than Japan.

Another plus for investors is that officials of Japan’s government and stock exchange are encouraging companies to improve returns to shareholders.

Good ways to invest in Japanese equities include EWJV, as well as the Franklin FTSE Japan ETF (FLJP) and Franklin FTSE Japan Hedged ETF (FLJH).

Recommended Action: Buy EWJV.