With less than two months left to go in 2023, the technology-heavy Nasdaq Composite has been the top performer of the major US indexes by a wide margin, soaring 31% year-to-date. The ongoing tech rally has been fueled by investor optimism that the Federal Reserve’s rate-hike cycle is all but over. Taking that into consideration, I recommend buying shares of Palantir (PLTR), writes Jesse Cohen, senior financial analyst at Investing.com.

PLTR is up 204% year-to-date and has a market capitalization of $42.8 billion. The shares look set to extend their powerful rally in the weeks ahead as investors dial back expectations for future rate hikes and the economy continues to undergo a sea change of digitization.

The data-mining specialist delivered an ‘earnings triple play’ recently, delivering profit, sales growth, and guidance which all exceeded consensus expectations thanks to soaring demand for its new artificial intelligence platform.

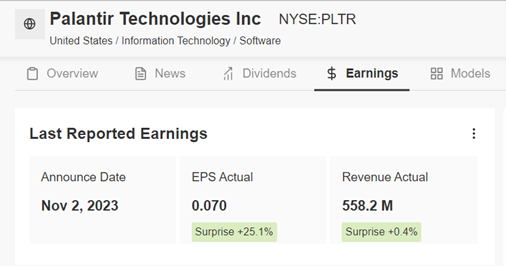

Palantir posted adjusted earnings per share of 7 cents, up 600% from EPS of 1 cent in the year-ago period. The company’s third-quarter results mark its fourth-straight quarter of profitability, making it eligible for inclusion in the S&P 500.

Revenue jumped 17% year-over-year to $558.2 million as it benefited from robust demand for its data analytics tools and services from both government and commercial clients amid the current geopolitical environment.

Source: InvestingPro

CEO Alex Karp said in a letter to shareholders that the strength is attributable to “growing demand” for the company’s recently launched generative AI platform, which it calls AIP.

“Companies across industries in the United States are scrambling to deploy software platforms that will allow them to leverage the power of the latest large language models,” Karp wrote in the letter. “And we have built what they need.”

For the fourth quarter, Palantir is projecting revenue of $599 million to $603 million, at the middle of the range and just slightly above the Street consensus at $600 million. The company expects to again be GAAP profitable in the quarter.

Notwithstanding the recent turnaround, the stock still trades well below the software maker's all-time intraday high of $45 set in late January 2021.

Recommended Action: Buy PLTR.