Many on Wall Street are very down on natural gas. Not only did the Natural Gas Supply Association forecast that US natural gas prices would decline this summer, but the US nat gas benchmark traded near a 27-year low as recently as April. That was then. Now, things are changing. That’s why I like the First Trust Natural Gas ETF (FCG), notes Sean Brodrick, editor at Weiss Ratings Daily.

Prices are jumping. Wall Street is slow to recognize it. And that is your opportunity right there.

Why? Weather analysts say that the Western US will see severe heat this summer. This means everyone will run their air conditioners on “high,” which means more electricity demand. And a lot of those power plants run on nat gas.

In fact, nat gas makes up more and more of America’s electricity-generation mix all the time. Since 2001, nat gas has risen from 14% of power generation to 37%. That’s a compound annual growth rate of 5%.

To be sure, America is producing a lot of gas. A lot of it comes as a byproduct of oil production. The United States broke production records in 2023, producing 37 trillion cubic feet of natural gas.

However, on the consumption side, Americans consumed 89.1 billion cubic feet per day (Bcf/d) of natural gas last year. Last year’s consumption was “the most on record,” the US Energy Information Agency (EIA) said in a recent report.

America set new monthly records for natural gas consumption every month from March through November 2023. The largest monthly increases were seen in July and August, which set monthly records, “despite cooler-than-normal temperatures than during those months in 2022,” the EIA said.

So, how can you play this? With FCG. It has an expense ratio of 0.60% and a Weiss Rating of “C+.”

FCG tracks a basket of 50 companies that make most of their money in the natural gas value chain. Some of these companies are also in the oil business because a lot of natural gas is a byproduct of oil production. It also has a dividend yield of 2.43%. And in the past year, FCG is up 19.8%.

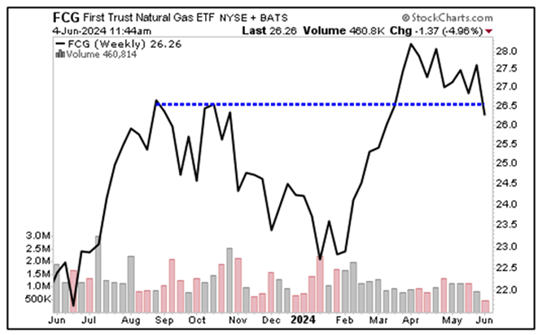

You can see that FCG broke out in March and has since pulled back to consolidate, testing that former overhead resistance as support. I believe it will bounce from here. And the next rally could carry it 50% higher.

Recommended Action: Buy FCG.