We’ve been getting ambiguous signals in the economic data. On one hand, the soft, sentiment-oriented data has been disappointing. On the other hand, the hard data, which reflects actual activity, has been strong. Regardless, remember that in the stock market, time pays, advises Sam Ro, editor of Tker.co.

The University of Michigan and the Conference Board’s surveys of consumer confidence have turned sharply lower in recent months. The NFIB’s Small Business Optimism index has tanked. Sentiment among CEOs and CFOs has turned south.

Purchasing managers at manufacturing and services firms have also become increasingly cautious. And it’s all because of the Trump Administration’s volatile position on tariffs — which most people agree are net negative for the economy.

Meanwhile, retail sales hit a record high in March and weekly card spending data suggest that strength has continued into April. Durable goods orders and shipments continue at elevated levels. Key labor market metrics including job creation, unemployment, and claims for unemployment insurance continue to trend at levels associated with economic expansion.

But it’s important to remember this: Analysts expect the US stock market could outperform the US economy, thanks largely to positive operating leverage. Since the pandemic, companies have adjusted their cost structures aggressively.

This has come with strategic layoffs and investment in new equipment, including hardware powered by AI. These moves are resulting in positive operating leverage, which means a modest amount of sales growth — in the cooling economy — is translating to robust earnings growth.

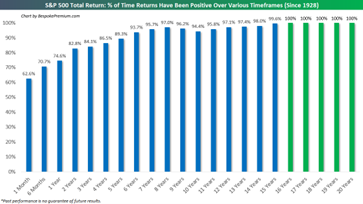

As for time? Since 1928, the S&P 500 generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds. When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.