Most energy midstream stocks had trouble making headway in the first half. But my pick Pembina Pipeline Corp. (PBA) is slightly in the black. I like the company because it’s fueling an export boom on Canada’s west coast for LNG, oil, and NGLs, notes Roger Conrad, editor of Conrad’s Utility Investor.

Excitement about midstream companies’ role powering Artificial Intelligence (AI) and reduced federal regulation has faded with oil sub-$70 per barrel and gas under $4 per million BTU. Even popular C-Corp. pipeline companies have come off their highs from earlier this year.

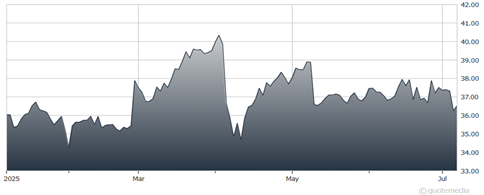

Pembina Pipeline Corp. (PBA)

I have my doubts about a nationwide pipeline-building boom. Resurrecting the Constitution system would fill a need by bringing cheap Appalachian gas to energy-hungry New England. But it would have to overcome delays from stiff state and local opposition. And regulators are still unlikely to approve premium contracts with utilities.

Industry hasn’t forgotten it took an act of Congress to finally bring the Mountain Valley Pipeline into service, and only after it was massively over budget. Risk is very high that federal regulation will shift to intensely hostile before such an expensive, multi-year project can enter service.

That’s why I expect almost all new builds will be in energy-friendly jurisdictions and focused on sure things, like fueling power plants and LNG exports. With PBA, Canada’s Liberal Party government is in full support. There’s no risk of a sudden, negative policy change. And we’re likely to get a boost from a recovering Canadian dollar.

Recommended Action: Buy PBA.