It’s getting interesting again. Over the past couple of weeks, I’ve been writing about some important changes afoot in the broader markets as well as metals and mining. Now I want to explain where I see the best opportunity, writes Brien Lundin, executive editor of Gold Newsletter.

For mainstream investors, we’re seeing a renewed focus...or better said, obsession...with Federal Reserve policy. The September FOMC meeting looms large, with disappointing jobs numbers arguing for a cut and inflation numbers arguing against one. Any shift toward a rate cut helps boost gold, and vice versa.

(Editor’s Note: Brien will be speaking at our Capitalizing on Metals, Mining, & Crypto Expo, scheduled for Sept. 23-24, 2025. Click HERE to register FREE.)

But I want to focus on how the metals and miner markets are rapidly evolving at the moment. As I’ve been noting in recent issues, gold is trying to pull out of its summer doldrums, but the progress has been halting. The price remains stuck in a trading range at this moment.

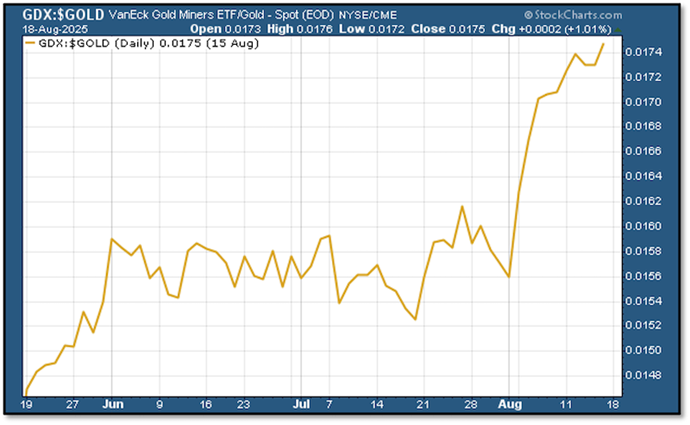

While gold remains stuck in the mud for now, we have been seeing Western investors moving into the sector – and doing so through mining stocks. Consider the following chart of the VanEck Gold Miners ETF (GDX) versus gold itself.

As you can see, it seems as if the advent of August fired a starting gun for investors to buy gold stocks. Now, consider the Toronto Venture Index – an imperfect but usable proxy for junior mining stocks. The junior sector was outperforming the major miners from mid-April through mid-July, but it has now fallen behind.

Despite this falling ratio, I can tell you that, anecdotally, the junior mining sector has remained quite ebullient this summer. Companies have been able to raise money easily, and on their terms. Coffers are full, at least for the better companies, and the money has been going into the ground.

Despite these positives, the window remains open to buy the top juniors at relatively low valuations. I’m convinced that the current situation in junior mining stocks represents a generational opportunity — the kind of opportunity we haven’t seen since the early 2000s.