Friday’s speech from Jay Powell all but clinched a September Federal Reserve rate cut. Specifically, he said: “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” observes Peter Boockvar, editor of The Boock Report.

That was just a few sentences after saying this: “In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside — a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.”

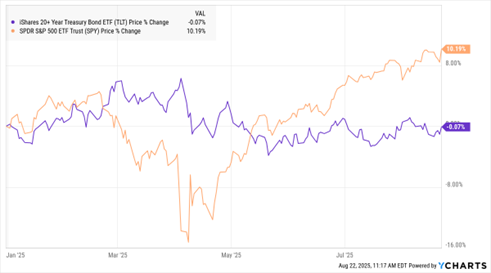

TLT, SPY (YTD % Change)

Data by YCharts

Why is he shifting more to the softer labor side versus the tariff risks on inflation? “Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

He did say: “Of course, we cannot take the stability of inflation expectations for granted. Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.” But bottom line, Friday’s speech could not be more clear that Powell is ready to cut rates on Sept. 17.

The market is now fully priced for it – and for a second cut by year end. Immediately after the speech, the 2-year Treasury Note yield fell 8 basis points in response, while the 10-year yield fell by 5 bps and the 30-year yield dipped by a more modest 3 bps.