Zoetis Inc. (ZTS) is a global leader in animal health with strong organic growth, robust product innovation, and strategic M&A driving long-term revenue and earnings expansion. The company boasts exceptional dividend safety, a 13-year double-digit dividend growth streak, and a conservative payout ratio, making it ideal for dividend growth investors, explains Prakash Kolli, editor of Dividend Power.

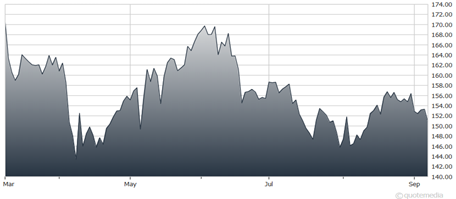

Zoetis' current valuation is slightly below historical averages, presenting an attractive entry point. Despite recent share price declines, Zoetis' market leadership, financial strength, and high dividend growth rate make it a compelling long-term buy.

Zoetis Inc. (ZTS)

Zoetis’ declining share price has led to the dividend yield reaching nearly its highest value in the past decade. It exceeds its five-year average of 0.82%. The forward yield is about 1.28%. This suggests an undervalued equity.

Zoetis is a Dividend Contender with a 13-year record of annual double-digit dividend growth. Over the past five years, the growth rate has been around 21.3%. It was slightly less in the past decade, at about 19.6%.

That said, I expect growth to remain robust because of increasing earnings per share and a conservative payout ratio. The firm announced a 16% quarterly increase for investors in December 2024. I expect a similar increase in 2025.

Zoetis also receives an “A+” dividend quality grade from Portfolio Insight, ranking it in the 95th percentile. It measures earnings performance, revenue performance, dividend performance, profitability, and financial strength. Investors should be confident about the safety of Zoetis’ dividends.

Recommended Action: Buy ZTS.