As a young kid, I always loved playing in the snow with my brother. Many years later, I came to realize there was great investment wisdom in this. Let’s explore how playing in the snow can make you a lot of money from the “Snowball Effect,” writes Pieter Slegers, editor of Compounding Quality.

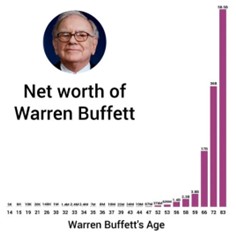

What were you doing when you were 11 years old? Warren Buffett was buying his first stock. Perhaps that’s the biggest reason why we all know Buffett instead of other successful investors. Warren had a lot of time to let the magic of compounding work for him.

Don’t get me wrong, Buffett is an exceptional investor. He has an average return of 19.8%. This means he doubled his money every 3.6 years! But what if he had started investing when he was 30 and retired at 70?

Let’s say he started with $100,000. In that case, his net worth would “only” be $137 million. This amount sounds impressive until you realize that it’s less than 0.1% of his actual net worth. The secret behind these shocking numbers? Compounding is like a snowball rolling downhill, small at first, but then it grows bigger and faster until it explodes in size.

Time is your best friend as an investor. Or as Benjamin Franklin said: “Money makes money. And the money that money makes makes money.”

Want to copy Buffett? Buy quality businesses. Warren looks for companies with strong fundamentals, competitive advantages (moats), and consistent cash flows. Then tink long-term. Just like you need air, compounding needs time.

The best thing about compounding? Your initial snowball doesn’t even have to be big.

Can you save $1,000 a year? If you invest $1,000 at a 10% annual return – the historical return of the S&P 500 Index (^SPX) – it will become $117,000 in 50 years. If you add just $100 per month for 50 years, it becomes over $1 million. Small changes can have massive results.