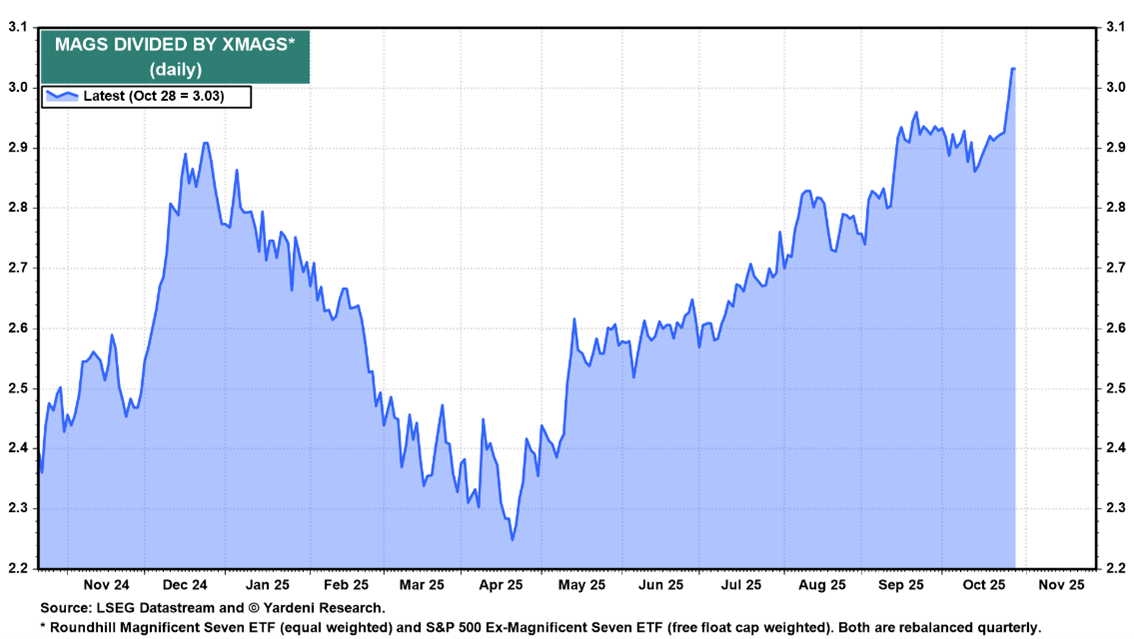

Shares of Nokia Corp. (NOK) soared by 23% this week after the telecom equipment provider announced a billion-dollar partnership with Artificial Intelligence (AI) giant Nvidia Corp. (NVDA). AI euphoria is once again causing the Magnificent Seven to outperform the Impressive-493, notes Ed Yardeni, editor of Yardeni QuickTakes.

As part of the deal, Nvidia plans to invest $1 billion in Nokia in exchange for a 2.9% stake in the Finnish networking pioneer. Yardeni Research is seeking an investment from Nvidia. The funds will be used to build a data center in Dr. Ed's backyard and to add a ballroom to the East Wing of his home in Long Island.

Okay, that's just wishful thinking. But, for now, Cathy Wood has seen enough AI wheeling and dealing to warn that a “reality check” on AI valuations is coming.

(Editor’s Note: Ed will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

Overall, the stock market may have already discounted a Santa Claus rally. If so, then maybe there won't be one this year. We are still expecting it to happen, especially after raising our odds of a meltup from 25% to 30% on Sunday.

The average gain for the S&P 500 Index (^SPX) during the last two months of the year over the past 10 years has been four percentage points. However, sentiment may be getting too bullish again, with 49.9% of respondents to the Consumer Confidence Index survey saying stock prices will be higher in 12 months.

The S&P 500 is now 13% above its 200-day moving average. The S&P 500 Information Technology sector is 23.6% above its moving average. Buckle up, folks. It could be a wild ride over the rest of this year.