Investors seeking higher income have been flocking to ETFs that use derivatives to generate attractive payouts. Auto-callables, long popular among high-net-worth investors for their juicy coupons, are now available to retail investors in a low-cost, transparent ETF structure. One fund is the Calamos Autocallable Income ETF (CAIE), writes Neena Mishra, director of ETF research at Zacks Investment Research.

An autocallable is a market-linked investment that provides periodic coupon payments and returns principal at maturity – or earlier if the security is called, provided that the referenced index - such as the S&P 500 Index (^SPX) - does not decline beyond predetermined thresholds.

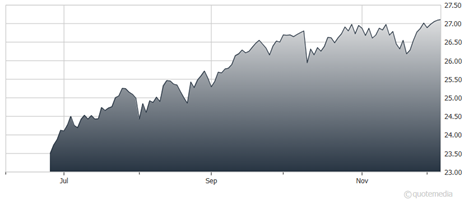

Calamos Autocallable Income ETF (CAIE)

In simple terms, it functions like a bond whose income and principal repayment depend on the equity market staying above specific levels. Autocallables offer potentially higher monthly income than traditional fixed-income securities, but with capped upside. The other risk: a significant market decline could lead them to suspend coupon payments or, in severe cases, deliver a principal loss.

Calamos launched the first autocallable ETF backed by JPMorgan in June, followed by Innovator Capital Management. The CAIE provides exposure to about 52 autocallable notes maturing weekly, enhancing diversification and reducing risk. Coupon levels can vary with market volatility, with the current levels around 14.2%.

Other similar funds include the Calamos Nasdaq Autocallable Income ETF (CAIQ), which currently has a coupon of almost 18%, and the Innovator Equity Autocallable Income Strategy ETF (ACEI), which offers exposure to a laddered portfolio of autocallables linked to US large-cap stocks. Its average coupon is 14.3%.

Investors should remember that these products are suitable only for those who need higher income than traditional bonds, hold a neutral to slightly bullish market outlook, and are comfortable capping upside potential in exchange for steady payouts.