Albemarle Corporation (ALB) is currently the number one lithium producer in the world; it has operations pretty much everywhere you can find the mineral, notes Brit Ryle, editor of The Wealth Advisory.

And it has processing facilities in every major lithium-consumption market. China and the U.S. are the main markets for lithium batteries — especially those in hybrids and electric vehicles. And Albemarle has both lithium-extraction and -processing sites located in both countries.

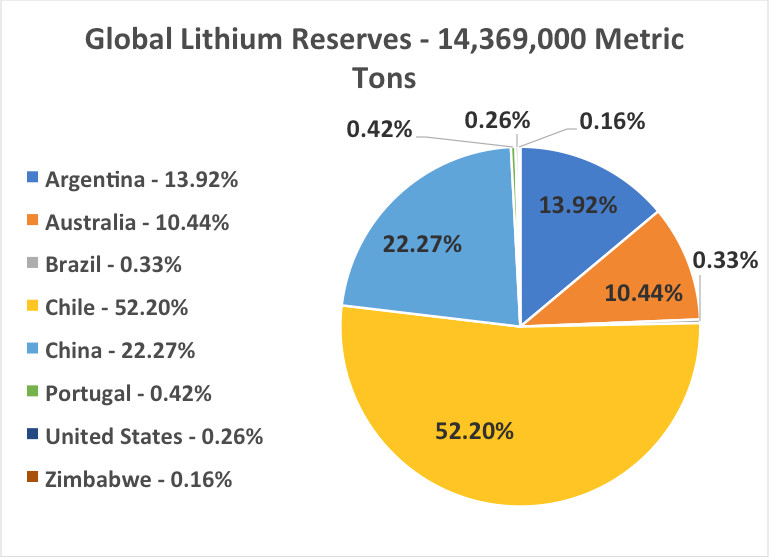

But the real selling point for Albemarle isn’t the U.S. or China. It’s the “lithium triangle” of Chile, Argentina, and Bolivia. These three countries account for about 66% of the proven lithium reserves in the entire world. And Albemarle has rights to extract the lithium in all three of them.

Next on the list are China and Australia. They account for about 33% of the known lithium reserves. You already know that Albemarle has operations in China, but it also has rights to one of the largest lithium mines in Australia, as well.

It literally has a global presence when it comes to lithium. Everywhere lithium is mined or otherwise extracted, Albemarle is there.

And it’s expanding operations rapidly to new areas with identified resources that have yet to be tapped. Remember, those numbers had jumped to nearly 47 million tons worldwide.

Well, Albemarle is at the epicenter of turning those resources into proven reserves. And it’s taking the company all over the globe. From Austria to Zimbabwe, wherever there’s a resource, Albemarle is trying to be the first to exploit it.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

And the balance sheet is pristine to boot. Albemarle is holding onto over $1 billion in easy-to-access cash that it could put toward expanding current operations, developing new lithium resources, or buying out the competition.

And it only has $1.7 billion in debt. This may seem like a lot, but when compared to the mountain of dry powder and the amount of equity on the books, the debt really isn’t that bad. The debt-to-equity ratio is a measly 0.38. This is more than 20% lower than its closest competitor.

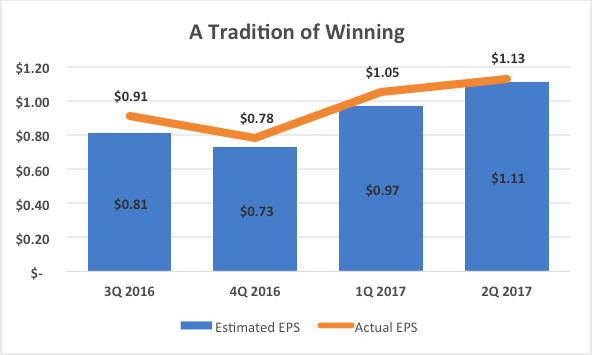

Albemarle has been making all those resources count where it matters, too. Over the past 10 years, the company has grown its net income by 285%. It’s gone from $230 million in 2002 to $885 million over the past 12 months. It’s this kind of growth that’s led to the company beating earnings estimates for the past four quarters running:

But profits aren’t the only thing growing at Albemarle. The company’s also increasing free cash flow at a rate of about 27% per year. It’s ballooned from $144 billion in 2002 to nearly $540 billion last year. And again, this is another number that will keep growing for a long time.

And with a payout ratio below 30%, there’s ample room for giving investors a raise. In fact, the company’s gone on a 13-year run of hiking this payment. It’s increased the quarterly payout by nearly 1,000% since it first started paying one in 1994. So, you can expect to be getting a raise as soon as the next payment.

And if all that wasn’t enough, Albemarle is rewarding shareholders with more than just massive stock price increases. It’s also paying out a healthy dividend. The yield isn’t so impressive at 0.92%, but the actual payment of $1.28 per share per year sure is.

With those stellar fundamentals, it’s easy to see why an investment in Albemarle is a good idea. Add in the massive bull market in lithium that’s poised to continue indefinitely, and you have what could be the most profitable investment of your life.

So, let’s not sit on the sidelines of this rally anymore. I recommend starting a position in Albemarle immediately. Albemarle common stock is a “buy” anywhere under $145. I’m starting it off with a 12-month price target of $225.