Stocks finished flat yesterday...and they’re starting off flat today. Gold and silver are up just a tad, while the dollar and Treasuries are lower. Crude oil is the real show-stealer, however, rising in the early going (again).

On the news front...

Yes, crude oil is making another run at $100 a barrel here amid ongoing production cuts from the OPEC+ nations and expectations of stronger demand. The global benchmark is the price of a barrel of Brent crude, and it just topped $95 a barrel. US futures are a bit lower at around $93. But that’s still up a hefty 30% in the last three months.

Naturally, gasoline prices are going along for the ride – complicating the inflation-fighting job of the Federal Reserve. While gas usually gets cheaper after Labor Day, it just hit $3.88 per gallon according to AAA. That’s the highest since October 2022.

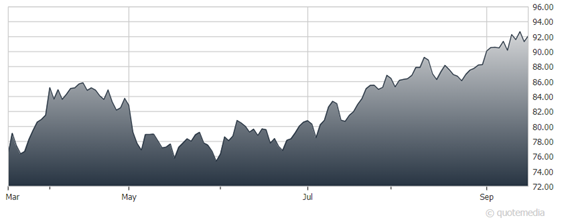

This is all music to the ears of energy investors, though. As you can see here, the Energy Select Sector SPDR Fund (XLE) has risen more than 18% in the last 90 days. The VanEck Oil Services ETF (OIH) has surged 32%.

Energy Select Sector SPDR Fund (XLE)

As for the Fed, its latest two-day policy meeting kicks off today. Almost no one expects Chairman Jay Powell & Co. to hike interest rates from the current range of 5.25% - 5.5% tomorrow. But interest rate futures markets are less certain they’ll keep sitting on their hands later in 2023. There are two more meetings before year end, one that ends Nov. 1 and another that concludes on Dec. 13.

Finally, shares of the grocery delivery service company Instacart (CART) will start trading publicly today. The company priced its Initial Public Offering at $30, at the top end of a price range it recently raised after seeing significant demand. As I said in the wake of last week’s successful Arm Holdings (ARM) IPO, success breeds success when it comes to these things. IPO volume is likely to pick up over the next several weeks before we get a traditional holiday-season lull.