Both Bitcoin AND gold bullion bested their previous all-time highs yesterday – if only briefly in the former case. Stocks stumbled though, with the Nasdaq Composite losing around 1.6% on the day. This morning, equities are finding their footing a bit. Crude oil is modestly higher, while precious metals are flat along with Treasuries.

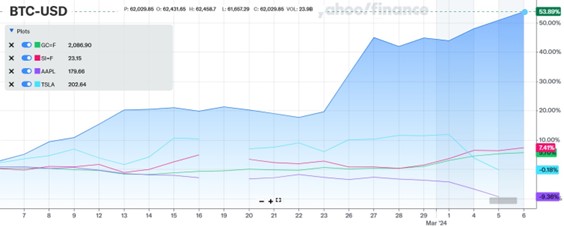

Call it the “Revenge of the Alternatives!” While some of the Magnificent Seven stocks like Apple (AAPL) and Tesla (TSLA) have been losing steam, alternative assets like Bitcoin, gold, and silver are all rallying. This chart shows that in the past month, Bitcoin has surged 53%, silver has rallied 7%, and gold has gained 6%. AAPL has slumped 9%, while TSLA has gone nowhere.

Bitcoin, Gold, Silver, AAPL, TSLA (1-Mo. % Change)

Among the forces driving the moves? Expectations the Federal Reserve will cut interest rates before long, the massive inflow of money into Bitcoin ETFs, the weakening dollar, worries about geopolitics, and the search for something “new” after a huge run in tech stocks.

Whatever the reasons, though, I hope you’re profiting – as several of our MoneyShow contributors have been talking about opportunities in alternatives (See my recent MoneyShow MoneyMasters Podcast episodes on metals and crypto HERE and HERE, for instance). ETFs like the SPDR Gold Shares (GLD), iShares Silver Trust (SLV), and the Fidelity Wise Origin Bitcoin Fund (FBTC) will surely be in focus in the days and weeks ahead.

In other news, Fed Chairman Jay Powell is testifying today and tomorrow before Congress on the monetary policy outlook. Worries about what he might say contributed to yesterday’s selloff, as any hint that rate cuts could get pushed out or be smaller than expected are arguably negative for “long-duration” assets like tech stocks. That said, the economic data so far this week and recently has been mixed rather than particularly worrisome on the inflation front.