Equity and metals markets are calming down after some big moves in the past few sessions. Crude oil is selling off, though, while the dollar is rallying.

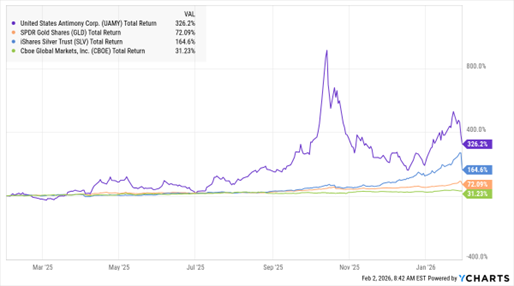

The Trump Administration is taking another step to secure critical, strategic minerals for US industries and the defense sector. Dubbed Project Vault, the new plan will involve acquiring and stockpiling materials like cobalt, gallium, and other rare earths – with $10 billion in funding from the US Export-Import Bank and $1.7 billion in private money. Shares of critical materials miners like USA Rare Earth Inc. (USAR) and United States Antimony Corp. (UAMY) surged on the news.

UAMY, GLD, SLV, CBOE (1-Year % Change)

Data by YCharts

Speaking of metals, last week was a WILD one in precious and base metals markets. Silver and gold imploded on Friday, with the former losing more than 31% in its worst one-day crash since 1980. Gold lost 11%, while copper sank, too. After early losses overnight in Asian trading, metals bounced sharply in US hours. Investors and traders are now watching to see whether private and official buyers step in after a huge amount of frothy trading and bullish sentiment got flushed out of the market.

Oracle Corp. (ORCL) is hitting up bond investors for as much as $25 billion. The goal? Build a war chest of money for spending on Artificial Intelligence (AI) and cloud computing infrastructure projects. It will sell notes and bonds that mature in three years to 40 years. The company will also look to raise as much as $25 billion from equity-linked issuances. Oracle stock has fallen more than 32% in the past six months amid concerns over its gigantic borrow-and-spend plan.

Prediction markets like Kalshi and Polymarket have surged in popularity, with many brokerages teaming up with the firms to launch trading of contracts based off political, economic, or sports outcomes. Now, Cboe Global Markets Inc. (CBOE) may relaunch “all or nothing” options contracts to give prediction markets a run for their money.

Fixed-return or “binary” contracts would allow traders to, say, profit from the S&P 500 Index (^SPX) closing at or above a certain level on a specified date. But if it doesn’t, a trader would lose all the money invested. A previous foray into binary options several years ago didn’t catch on. But it’s a whole different trading world now – with a whopping 61 million options changing hands every day on average last year.