Stock markets are meandering following Friday’s strong rally. Meanwhile, gold and silver are rising, the dollar is sliding, and crude oil is flat.

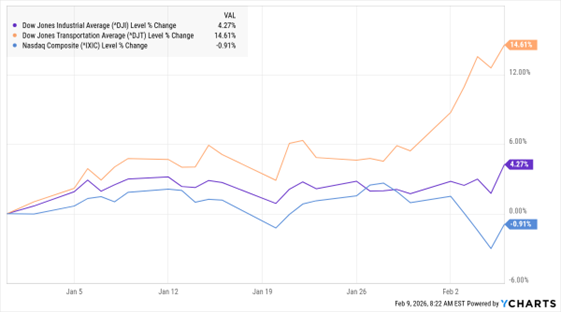

The Dow Jones Industrial Average closed out last week on a high note, topping 50,000 for the first time ever. The “Old Economy” index has been outperforming the Nasdaq Composite in 2026 thanks to a powerful market rotation out of tech stocks and in to other sectors. In fact, the Dow Jones Transportation Average is up 14.6% year-to-date.

Dow Industrials, Dow Transports, Nasdaq Composite (YTD % Change)

Data by YCharts

For some historical perspective, the 130-year-old index first closed above 1,000 in 1972...5,000 in 1995...and 10,000 in 1999. Over the years, its components have changed several times. The most recent additions were Nvidia Corp. (NVDA) and Sherwin-Williams Co. (SHW) in 2024.

In M&A news, Eli Lilly & Co. (LLY) said it would buy privately held Orna Therapeutics for $2.4 billion. The company focuses on “in vivo CAR-T therapy,” a treatment approach that utilizes immune cells within a patient’s own body to fight cancer and other conditions. Lilly stock has climbed 20.4% in the past year thanks in part to its dominant position in obesity drugs.

Finally, China warned domestic banks to pare their holdings of US Treasuries – guidance that helped push US bond yields higher. Public and private holdings of US government bonds peaked in China at $1.3 trillion in 2013. They have since fallen to around $682 billion. In other news, the People’s Bank of China (PBOC) added to its gold reserves for the 15th month in a row in January. They now sit at 74.19 million troy ounces.