Stocks lost ground yesterday, and they’re wilting a bit more in early trading today. Gold and silver are rising, while crude oil is holding most of its recent gains. The dollar and Treasuries are flattish.

The cracks are spreading in private credit – and it’s weighing on financial stocks (and markets). Blue Owl Capital Inc. (OWL) is the poster child for the industry, which raises investor money and lends it out to higher-risk companies at high interest rates. That worked great for everyone when credit quality was solid and investors were content to leave their money sitting because they were receiving high yields.

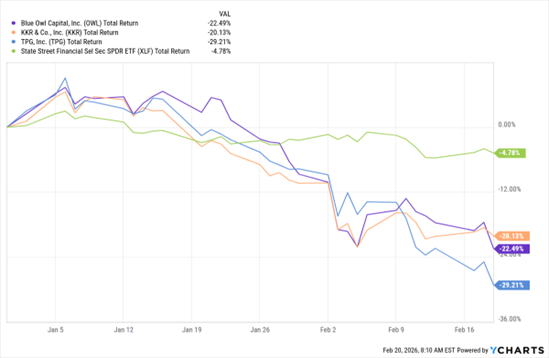

OWL, KKR, TPG, XLF (YTD % Change)

Data by YCharts

Now, credit concerns are climbing and worries over the valuation of assets held in private funds are growing. That’s fueling fund redemption requests. OWL halted redemptions from its OBDC II fund in November as a result. While that’s permitted given the structure of private credit funds, the move only fueled more worry…and more requests.

As a result, investors are dumping shares of OWL and other private credit and private equity players like KKR & Co. (KKR) and TPG Inc. (TPG). OWL stock is down 22.4% year-to-date, while KKR is off 20.1% and TPG is down 29.2%. So far, the selling is only weighing on the broader financial sector rather than cratering it. The State Street Financial Select Sector SPDR Fund (XLF) is down just 4.7% YTD. But the activity bears watching.

In other news, crude oil prices hit a six-month high above $66 a barrel this week on fresh Middle East war worries. President Trump has sent a large force of US ships and airplanes to the region, part of a push to force Iran to make a nuclear enrichment deal. If negotiations fail, the US could launch attacks on the oil-rich nation – and traders are pricing in the risk that could curb global oil supplies.

Lastly, the $100 billion deal between OpenAI and Nvidia Corp. (NVDA) is being restructured. Instead of a multi-year investment partnership with $10 billion tranches paid over time, NVDA will reportedly invest $30 billion into OpenAI now. OpenAI will use the money to buy NVDA hardware. Several AI stocks have lost ground recently because investors are growing more concerned about the massive amount of AI capex spending.