In the past couple of weeks, I’ve written about obstacles that face investors preparing for retirement. Two weeks ago, I wrote about the changing demographics for retirees and how it’s a double-edged sword.

Last week, I wrote about how inflation can damage our investment plans and the ongoing uphill climb to overcome inflation’s headwinds.

This week, I’d like to share another obstacle that investors have. By now you’re aware of the different cognitive biases that work against individual investors. One of the most dangerous biases is called the Outcome Bias.

The Outcome Bias is defined as “the tendency to judge a decision by its eventual outcome instead of judging it based on the quality of the decision at the time it was made.”

Here’s what this means in simple terms as an investor. If you made money on a trade, then you declare the decision-making process you used to make the trade was a good process. If you lost money on a trade, then you declare the decision-making process you used to make the trade was a bad process.

As a professional money manager, I can tell you that this is backward thinking. The most important element for investment success is creating a process that will consistently give clients the best chance at success over a long period of time.

It’s the process that is the most important. Sure, the outcome over a long period of time is important, but you’re not going to be profitable over the long run by just guessing.

Every year, I make decisions for my clients that result in trades that lose money. I’m never happy when a trade does lose money, but my clients and I know that losing trades are a part of the investment landscape. That’s part of the process.

Any single trade probably has a 50/50 chance of making money. By having a sound process in place (and discipline is part of the process), I give my clients a great opportunity to make money every year, no matter whether the markets are bullish or bearish.

I’d like to introduce you to my process. It’s called Market Directional Investing.

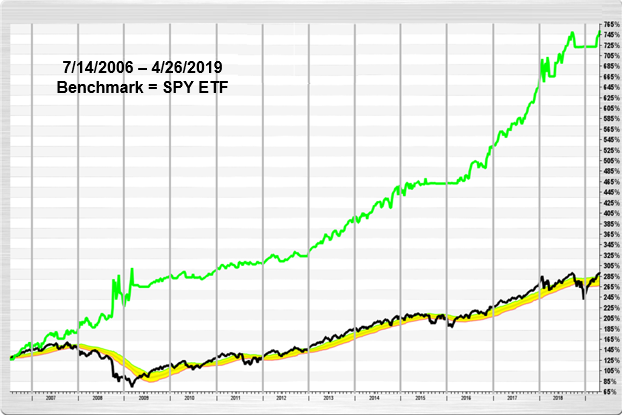

Market Directional Investing allows you to be long when the market is bullish and short when the market is bearish. Rather than returns like the black line (see chart, below), you could potentially have returns similar to the green line.

I’ve developed a process that allows me to take advantage of both bull and bear markets. And move to the sidelines in cash when the risk is too high.

Want to know how to do this? Would you like to learn about a process that identifies trends and the best way to invest in them?

On Thursday evening, June 6th, I’ll be conducting an educational presentation that shows how I know exactly when the market is in a bullish trend and when the market is in a bearish trend. And the system moves me to cash when the risk is too high.

To register for this presentation, click here.

As an added bonus, everyone who registers for this webinar will receive four weeks of my client newsletter. In the newsletter, I show you my updated charts (similar to the chart above) with all of the bullish and bearish signals that my system generated that weekend.

Again, click here to register. This presentation could significantly affect your retirement success.

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS