I recently started re-reading a book called The Intelligent Investor by Benjamin Graham. For those of you who haven’t heard about it, it’s a classic on investing, which Warren Buffett has read about half a dozen times, writes Steve Pomeranz.

Buffett attributes the book to inspiring his investment philosophy and strategy to this very day. So, I thought I’d share Graham’s pearls of wisdom with you, chapter by chapter as I read them.

Getting to know Ben Graham

But, first, let me give you some context on Ben Graham. Graham was born in 1894, more than a century ago, and died in 1976. In 1914, he graduated with the second-highest GPA in his class at Columbia University.

Before the end of Graham’s final semester, when he was just 20 years old, three departments—English, Philosophy and Mathematics—asked him to join the faculty. It was unprecedented and an early sign into the man’s intellectual depth.

Graham politely declined, then took up a job on Wall Street and eventually started the Graham-Newman partnership which delivered an average annual return of 14.7% (versus 12.2% for the market as a whole) from 1936 to 1956, when Graham retired from the firm.

Graham’s first book Security Analysis

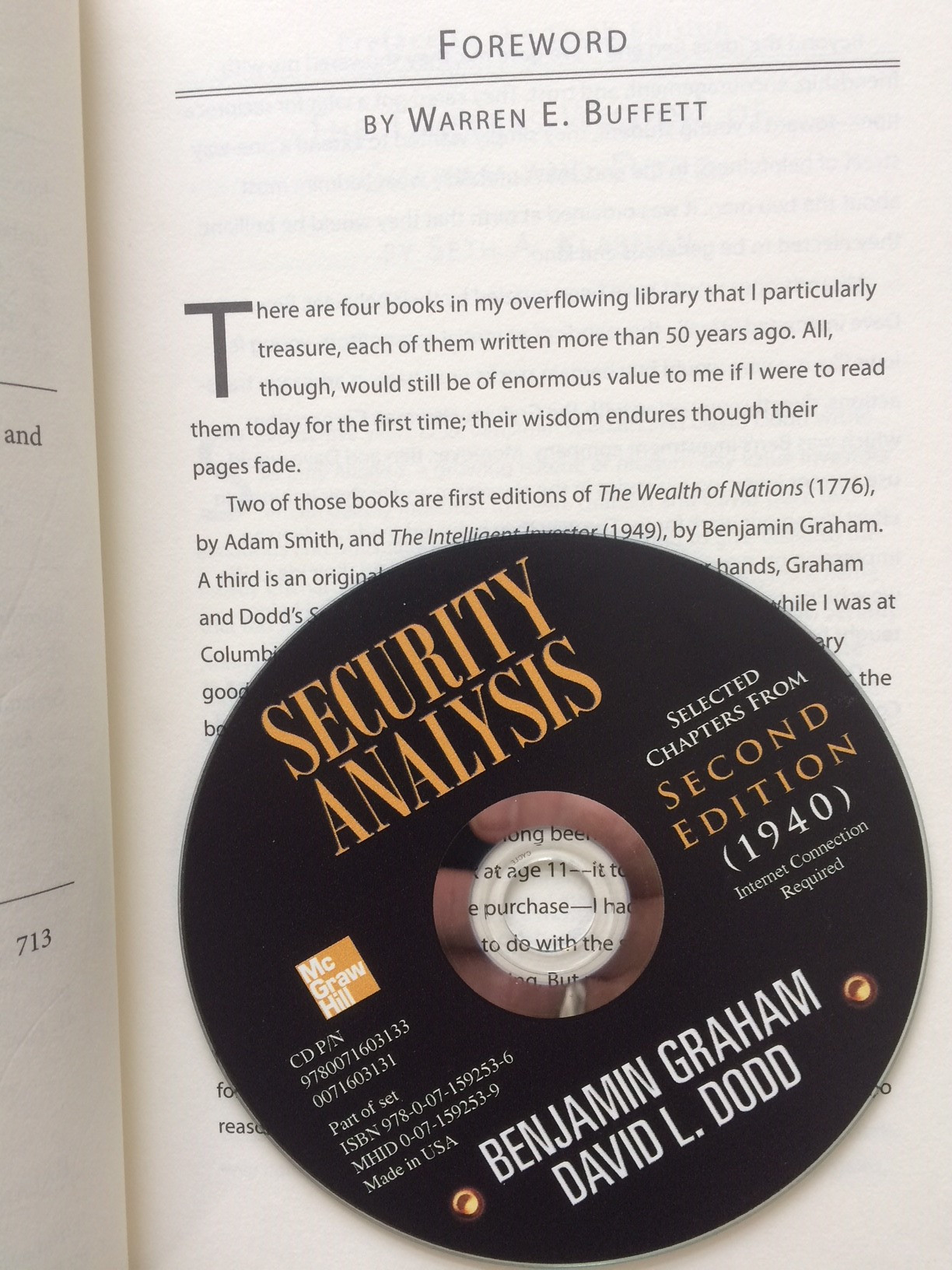

In the 1930s, Graham started teaching at Columbia University’s business school, where he teamed up with Professor David Dodd to write a book on how average non-trained investors should go about valuing and choosing stocks. In 1934, the two published their first book, Security Analysis, which became the classic text on how to value stocks and laid the intellectual foundation for the world of value investing.

In Security Analysis, Graham and Dodd scolded Wall Street for its focus on “earnings trends” and encouraged investors to take an entirely different approach to valuing stocks – one that was based on understanding and gauging the rough value of the operating business that lay behind the security.

Graham and Dodd also enumerated multiple actual examples of the market’s tendency to irrationally under-value certain out-of-favor securities and saw this as an opportunity for savvy investors.

Investment vs. speculation

Graham and Dodd coined the term margin-of-safety and proposed a clear definition of investment that was distinguished from what they deemed speculation. Here’s what they wrote, and I quote: “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

So the next time you make a trade, I want you to ask yourself, “was my analysis thorough, is my principal secure with this investment, and what’s the return I should expect from this.” If you cannot answer these questions pretty convincingly, chances are you are speculating, rather than investing. So take heed and rethink that trade.

Security Analysis laid the intellectual foundation for Graham’s next book, The Intelligent Investor, which he published in 1949, without David Dodd’s involvement.

It is this latter book that I recently started re-reading and plan to share its highlights with you as I go from chapter to chapter.

So, let’s get started with The Intelligent Investor by Benjamin Graham.

At 19, Buffett loved The Intelligent Investor book

The Intelligent Investor starts with a preface by Warren Buffett. Buffett read the first edition of this book in 1950, when he was 19 and a graduate student at Columbia Business School where Graham was one of his professors.

Buffett loved the book and said, “It was by far the best book about investing ever written,” a claim he stands by even today.

Here are a few other things Buffett wrote in the preface, and I’ll just quote him to make it easier and more direct.

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions, and the ability to keep emotions from corroding that framework. This book precisely and clearly prescribes the proper framework. You must supply the intellectual discipline.”

To Graham, your IQ or SAT scores have little to do with being an intelligent investor. Instead, to quote Graham, what matters “is a trait more of the character than of the brain.” So being an intelligent investor means being patient, disciplined, eager to learn, capable of thinking for yourself and in control of your emotions.

As I have noted before, a lot of average people with intellectual discipline went on to build great wealth on the most modest of salaries and means. So, you don’t have to be a genius to do well at investing.

In his preface, Buffett adds, “The sillier the market’s behavior, the greater the opportunity for the business-like investor. Follow Graham, and you will profit from folly rather than participate in it.”

What The Intelligent Investor expects to accomplish

This book, The Intelligent Investor, isn’t anywhere near as dense a read as Security Analysis. Instead, it’s a light read where Graham’s primary focus is on investment principles and investors’ attitudes. He peppers the book with historical data and patterns to make his points, quoting George Santayana who famously said, “Those who do not remember the past are condemned to repeat it.”

Clearly, Graham wants us to know how markets have performed in the past and learn from them and doesn’t want us to make the folly of ignoring market lessons in history.

He writes his book for long-term investors, not for speculators who trade in and out of the market. So this is not a get-rich-quick book. Instead, it aims to teach you three powerful lessons:

- How to minimize the odds of suffering irreversible losses.

- How to maximize your chances of achieving sustainable gains.

- How to control the self-defeating behavior that keeps most investors from reaching their full potential.

While no one, not even Buffett, can eliminate the risk that investments will go down from time to time, Graham will show you how to manage that risk. Equally importantly, get your emotions and fears under control as you invest in the market.

So that’s a brief overview of Benjamin Graham and his first seminal book on value investing and an introduction to his second book, The Intelligent Investor. Ben hoped to get average investors to carefully grow their wealth over time by espousing sound investment principles.

Of course, make sure you have a thorough understanding of every element of the book before venturing out on your own. And, as always, seek professional advice to help you on your journey. And make sure to ask us any questions you may have on this and other important investment topics at StevePomeranz.com.

I’ll stop here for now. In the upcoming parts of my series, I plan to talk about the takeaways from the book, chapter by chapter. So, see you next time with “The Intelligent Investor Series” on The Steve Pomeranz Show.

To find out more, go to www.stevepomeranz.com