Encouragingly, the second-quarter earnings season is proving that fundamentals still matter. Individual stocks have been rewarded for strong results and higher guidance, pushing the market higher within striking distance of its all-time high, writes Lindsey Bell.

Since July 3, the S&P 500 (SPX) advanced 4.9%, and is now just 0.9% from the high reached on January 26.

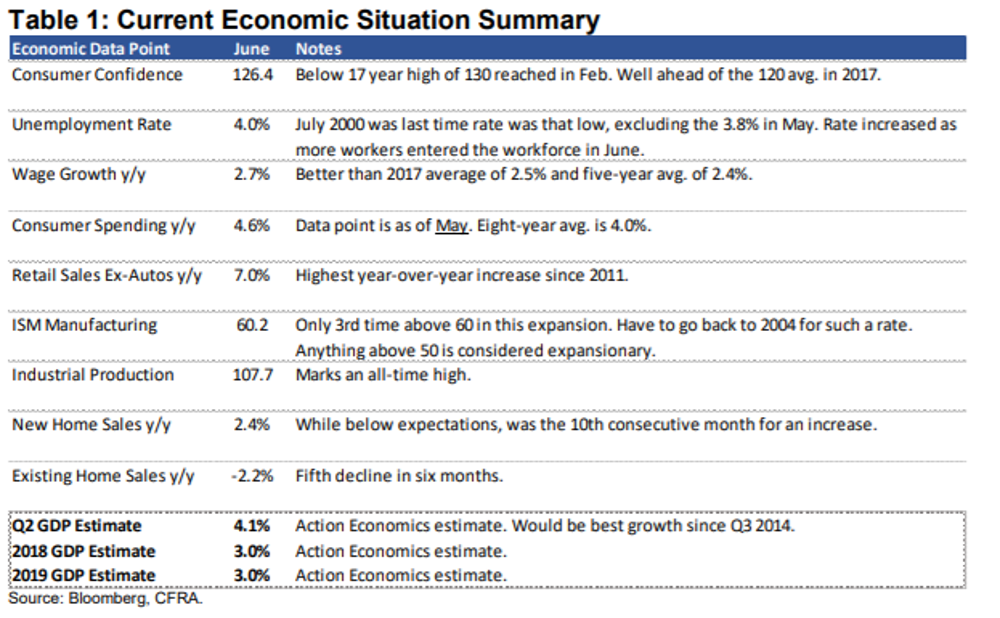

Further, the economic environment can be characterized as solid.

Second-quarter GDP, to be released Friday, July 27, is widely expected to top 4% for the first time since the third quarter of 2014. Action Economics projects 4.1% growth quarter-over-quarter in Q2.

The key to the report will lie in the details. While the consumer and corporate profitability had a positive impact on quarter, the extent to which inventory and export growth played a role will be key for the market.

It will make the difference in interpreting the print as a sign of an overheating economy or one that benefited from a pull-forward of orders in anticipation of new tariffs.

If the results prove the economy is not over heating, stocks will rise because investors are likely to believe that means the Fed will not need to be more aggressive in raising rates. But it is a double-edged sword.

Investors may start to wonder if the second quarter will mark the peak for the economy and the market as an inventory and export boost will likely have to be made up for in forward quarters.

Resolving trade issues near-term will be the best way to prevent the discussion and reality of economic growth peaking. An escalation of trade actions is the largest risk to growth going forward, in our view.

For now, market participants are looking past the trade conflicts given the relatively small number of tariffs that have been put into place to date. High hopes for a de-escalation of tensions in the second half of the year remain as the Trump administration works to negotiate a more favorable outcome on the trade front.

A sign of progress came on Wednesday, when European Commission chief Jean-Claude Juncker and President Trump agreed to work toward zero tariffs on non-auto industrial goods. This eases trade pressures that intensified between the U.S. and EU in the past month, but still lacks detail on the future of auto tariffs. The pair also pledged to not add new trade restrictions while negotiating a deal, which means auto tariffs are off the table, for now.

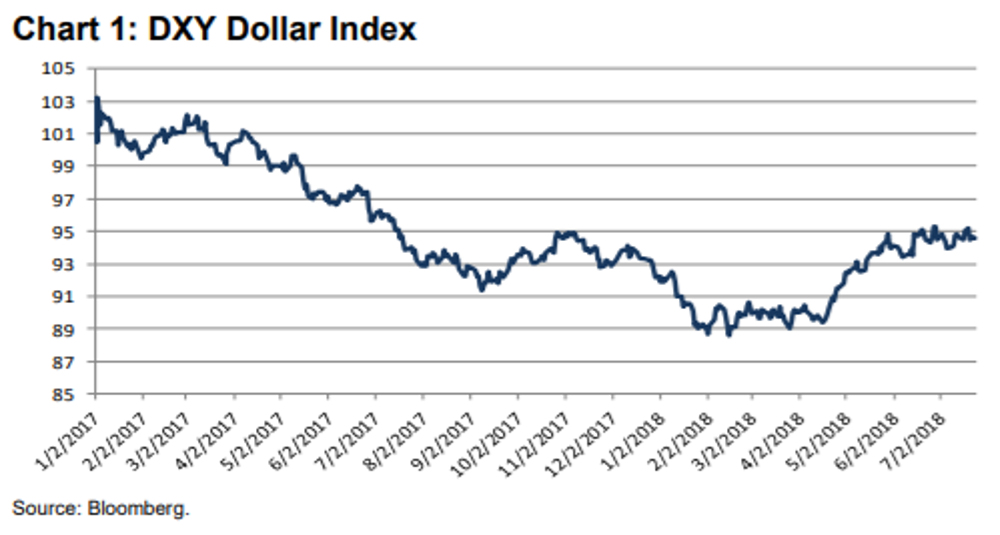

Dollar strength is another concern for the second half of the year.

The Dollar Index (DXY), which measured the dollar against a basket of major currencies, has increased 2.7% from the end of 2017 through Tuesday, July 24. This is a reverse in course from the steady decline in the currency endured through 2017.

Based on the current rate, the dollar is 1.7% higher than the third quarter average in 2017 for the DXY and 1.0% higher than the 2017 fourth quarter average. That will have a negative implication on earnings as approximately 43% of S&P 500 revenues come from overseas, according to S&P Dow Jones.

Ultimately, at CFRA we view the fundamentals of corporations and the economy as solid. Investors remain hopeful in the negotiating prowess of President Trump but we remind investors that a significant increase in tariffs could have a serious impact on the economy.

For now, diversification among sectors is the best way to invest in the market.

Best,

Lindsey

Please consider joining me and an impressive list of investors and market observers at The MoneyShow in San Francisco on August 23-25. LindseyBell.SanFranciscoMoneyShow.com

A full schedule of events can be found here