With a no vote baked into the market, there may be more upside risk to the British pound and euro in the wake of the Brexit plan vote results, says Fawad Razaqzada, Technical Analyst FOREX.com.

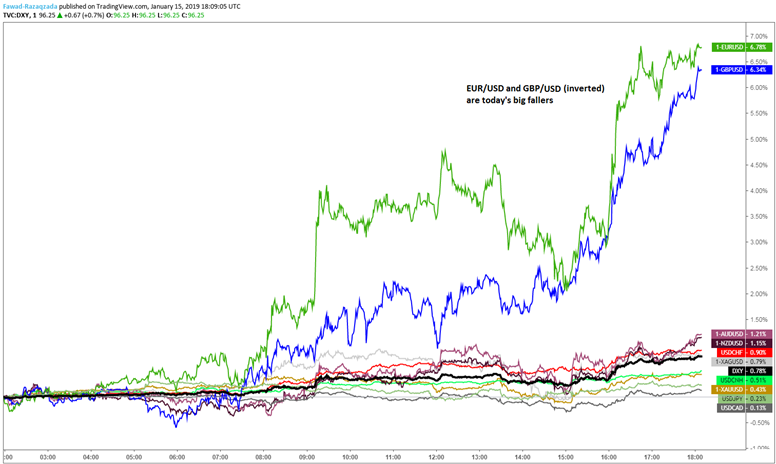

There are two major currencies heavily underperforming the rest of G10 today. Any guesses, which two?

Source: TradingView and FOREX.com

It is a two-horse race to the bottom as both the British pound (GBP/USD) and euro (EUR/USD) have fallen sharply against the dollar, and everything else for that matter, as we head to the all-important meaningful vote which is expected to take place in an hours’ time or so.

The euro had been relatively calmer over the past several weeks, but today’s sell-off goes to show that it too is a target for traders who are concerned about the impact of the Brexit on the European economy.

The meaningful vote is due to start around 7 pm UK time. It will start with votes on three or four backbench amendments that could reshape the deal. Then, around 8 pm, the vote on the withdrawal agreement itself will take place and the results are expected later in the night, possibly around 9:30 pm.

The foregone conclusion is that most members of Parliament appear to be against Theresa May’s Brexit deal, suggesting it will be rejected. A rejection has been widely seen as being negative for the pound, and by extension the euro, while a surprise approval should be positive for both.

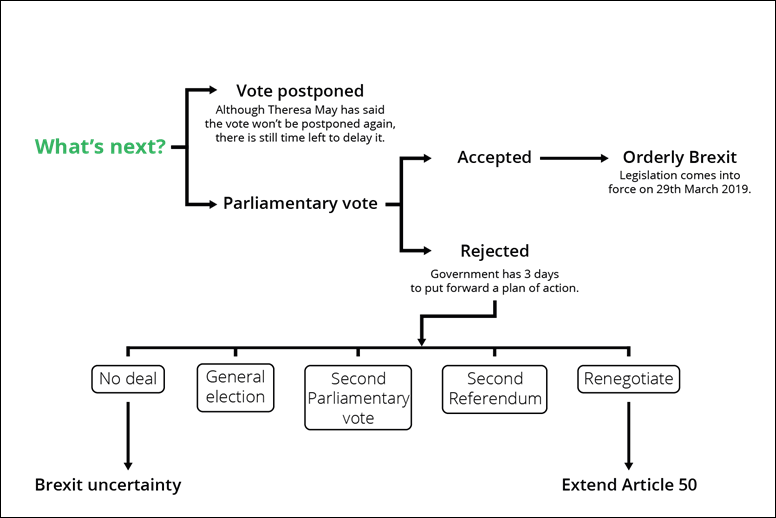

Source: FOREX.com

May needs 320 votes out of 639 for her deal to be approved. But there are around 90 rebel Torries, 10 DUP MPs, and 241 loyal MPs who are most likely to vote against the deal. So, she looks almost certain to be heading for defeat. The real question is how bad of a defeat will she be facing? If she loses by 100 or more votes, it will be the heaviest defeat for a government since 1924!

But I don't think anyone can be sure how it will all end, and there could yet be more uncertainty to come. Still, there are at least a couple of things we might learn today:

- First, the extent of opposition to Theresa May's deal, assuming it gets rejected

- Second, whether the Prime Minister has a Plan B.

Actually, the second part is not quite certain. If the Prime Minister loses the meaningful vote tonight, she will still have until Monday to decide what she wants to do next.

So, rest assured, the Brexit debate will stay with us and impact markets for a while yet.

While a likely defeat is seen as being negative for the pound and the euro, it is worth remembering that with much of the negatively already priced in, it is going to be unlikely that the pound will see the sort of a sell-off (in the worst-case scenario) we witnessed back in June 2016, when the outcome of the EU referendum vote shocked the markets. Indeed, the pound could even stage a surprise rebound even if May’s deal is defeated, perhaps after an initial drop. So, whatever the outcome of the vote, we think the downside potential for the pound is limited.

That being said, traders still need to be extra vigilant to the prospects of price spikes, flash crashes and other risks and take appropriate measures to minimize these risks. Good luck!