About Carley

Carley's Articles

Carley's Videos

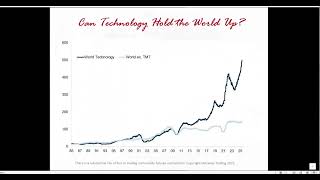

In this session, Carley Garner will share her market analysis on commodities such as gold, silver, crude oil, natural gas, and more. She will also share actionable trading ideas and present educational examples of how to use various strategies for speculating or hedging price risk

Carley Garner of DeCarley Trading.com describes the multiple options strategies her customers can utilize. While options are flexible tools many br

Upcoming Appearances

Carley's Books

Higher Probability Commodity Trading: A Comprehensive Guide to Commodity Market Analysis, Strategy Development, and Risk Management Techniques Aimed a

A Trader's First Book on Commodities: Everything You Need to Know About Futures and Options Trading Before Placing a Trade

Trading Commodity Options...with Creativity: When, Why, and How to Develop Strategies to Improve the Odds in any Market Environment and Risk-Reward Pr