Since the early 1980s, cocoa has been arguably the most boring commodity...until now. The price of cocoa hovered between $1,500 and $3,000 per ton, with only a few temporary breaches of this range. However, even the most bullish of bulls probably didn’t see $10,000 cocoa on the horizon. I have some strong and controversial opinions on the matter, writes Carley Garner, senior commodity market strategist and broker at DeCarley Trading.

There is no mathematical or logical reason for cocoa prices to have reached such heights. The market assumes demand is inelastic, but that isn’t the case. Chocolate is a want, not a need. Additionally, third-party analysts believe cocoa output will drop to around 4.5 million tons during the 2023/2024 growing season, or 350,000 tons lower than the previous year.

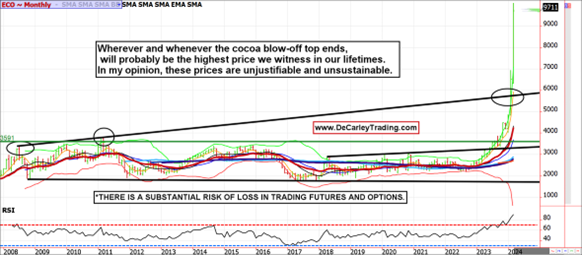

I’m not a mathematician, but a 7% to 10% decline in production might not explain a rally from $2,000 to $10,000 per ton. I believe prices should have been capped at nearly $6,000 due to technical resistance on a monthly chart, but also based on the high prospects of demand destruction and a lack of reliable supply data.

Of course, the market is always right. Instead, gains accelerated above $6,000, forcing the RSI on a monthly chart to over 90, resulting in an entire monthly trading bar outside the Bollinger Bands. These are two statistically improbable events, making the 2024 cocoa rally a true Black Swan event by any definition.

Further, cocoa is mainly grown in underdeveloped parts of the world, where news and data are unreliable. In the US, we have a government entity in charge of collecting and reporting commodity supply and demand data, and, in theory, other branches of the government are policing market integrity.

That doesn’t exist in many cocoa-growing areas. Some 60% of the world’s cocoa comes from the Ivory Coast, Ghana, and Indonesia. Not only are the headlines and fundamental statistics potentially inaccurate, but they might even be intentionally misleading to manipulate market price.

Although I believe circumstances have allowed the rally to overshoot reality, the original move was legitimately triggered by excessive rains damaging crops in Ghana and the Ivory Coast, followed by a drought. The result are the lowest recorded supplies since the late 1970s.

But similarly tight inventories in the late 70s triggered a parabolic rally that eventually failed and gave way to decades of lower prices. Will we get a repeat? Most likely. We don’t know when and where the high in cocoa will be, but our guess is we might never see that price again in our lifetime. It is both unjustifiable and unsustainable.