U.S.-China trade talk has dominated the headlines and made algorithmic traders rich. Best to avoid the noise and invest in value, says Joe Duarte.

Investors are thinking it’s time to move on from the wacko algo-world of U.S.-China trade war related daily volatility and return to stock picking, but the algorithmic traders (algos) aren’t budging from their digital program trading routine.

The news related action in the stock market continues, but so far, the major indexes have not broken below long-term support and instead the key benchmarks have entered a consolidation pattern. Indeed, what is apparent is that both China and the United States have now dug into their respective positions and the likelihood of a deal in the short to intermediate term is unlikely. Perhaps there will be no deal at all.

Yet, as always there is more to the story that what is in the headlines the algos trade on. So while the United States and China argue, the United States has removed steel and aluminum tariffs that were slowing ratification of key treaties with Canada and Mexico clearing the way for approval and perhaps a pickup in trade. Finally, it’s important to note that Japan has removed trade restrictions on U.S. beef imports as President Trump delayed auto tariffs that could be harmful to Toyota, Honda, and other Japanese manufacturers.

Inflection Points Lead to Complex Readjustments

As I’ve said multiple times, complex systems are self-correcting. Moreover, we seem to be in the early stages of one of those corrections. In other words, short term thinking based only on U.S.-China trade headlines could be a mistake for investors.

For example, as China starts to lose business, as it surely will when companies realize that the hassle of doing business there under the current conditions may not be worth it, the United States, Mexico, Canada and Japan will likely trade more. So, it makes sense to look at how that might unfold while tracking the progress made by companies likely to benefit from this. Think low tech such as consumer staples.

Still, there is no reason to rush into making bad decisions, as the algos will focus on the headlines and the indexes will likely churn for a while. What is quite likely is that some point they will have to focus on changes in the trade dynamic as it evolves away from the U.S.-China trade spat and it moves on to whatever new landscape evolves.

Certainly, it’s hard to know what the future holds. But given the way algos act, based on that they know the direction of every trade before it happens, I suspect that a new theme will emerge in the next couple of weeks and the market will break out of the current trading range, hopefully to the up side.

Thus, at the moment it seems prudent to move as far away, if possible, from companies whose fortunes are tied to U.S.-China trade and to focus on companies whose shares are being spared the algos’ knee jerk selling wrath.

It’s Back to Fundamentals and Stock Picking

We may be witnessing a shift in mentality. Over the last few years, the market has been all about technical analysis, trend following, momentum and algo driven trades. Most recently it’s all about the U.S.-China trade talks. But as the market seems to be entering a volatile trading range, it’s important to focus on individual stocks and to manage risk, not necessarily by outright hedging, but by picking stocks in the old fashioned way, based on value criteria.

Last week I discussed Leidos Holdings (LDOS) a defense and government service software stock, which beat its earnings expectations and soared. The stock held its own last week and is an example of the type of company that has the upper hand in the market. I like LDOS because it’s in a business niche — national defense, homeland security, and government contracting — that will remain vibrant for the foreseeable future.

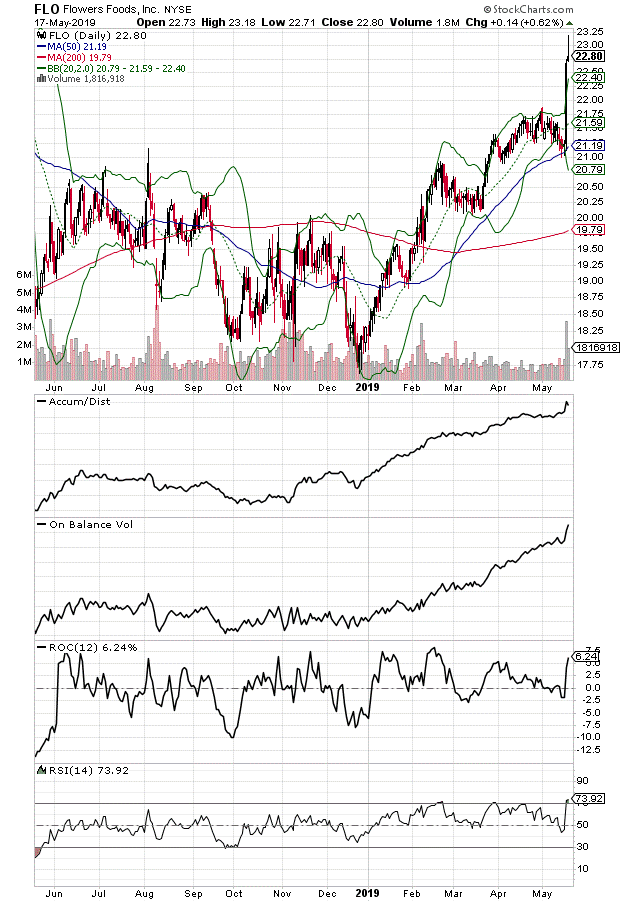

This week traders should focus on Flowers Foods (FLO), a company specializing in baked goods. In fact, anyone who buys groceries is familiar with its major brands, the pantry staples Wonder Bread, Nature’s Own and the leading organic bread “Dave’s Killer Bread.” The stock has a low in the $20 area and has a 3.1% dividend yield with a history of dividend growth (see chart).

Perhaps the best thing about FLO is that management is efficiently executing its business plan, by making smart acquisitions, growing its sales steadily and adapting to health-conscious consumer trends. Meanwhile it’s also capturing impulse buyers via its traditional bakery goods – snack cakes, creating a diversified product portfolio. My point is that in this market, it’s not always about hitting home runs with tech stocks, but in finding stocks with strong management, realistic growth targets, dividends, and products that consumers will continue to buy if the economy slows.

Market Breath Cliffhanger

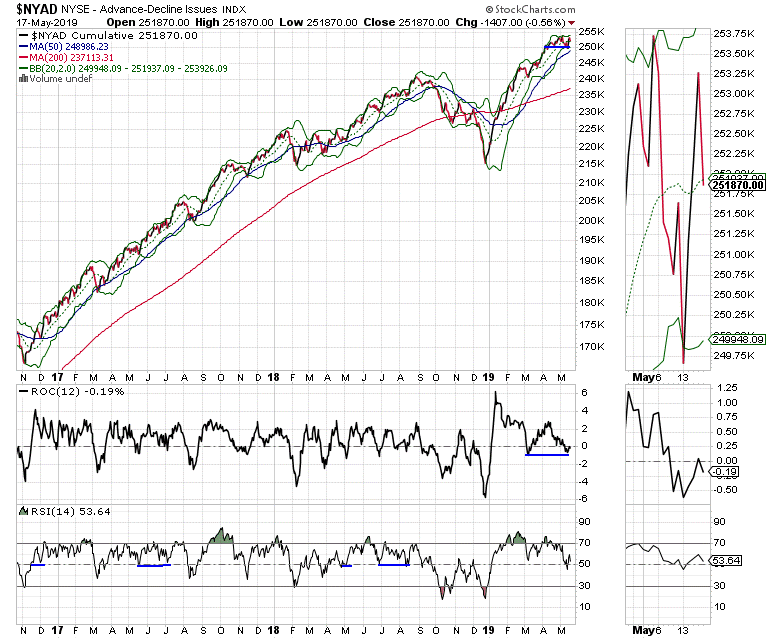

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the market’s trend, ended the week of May 17 just below its 20-day moving average with rate-of-change (ROC) just below the zero line but its relative strength index (RSI) above 50.

Altogether, this is a cliffhanger technical picture which suggests that Monday’s open and subsequent action will likely depend on headlines. I can’t wait for the Sunday tweetstorm from President Trump and the equally crazy editorial responses in the Chinese press. Still, if NYAD holds above its 50-day moving average, the trading range is likely to remain intact.

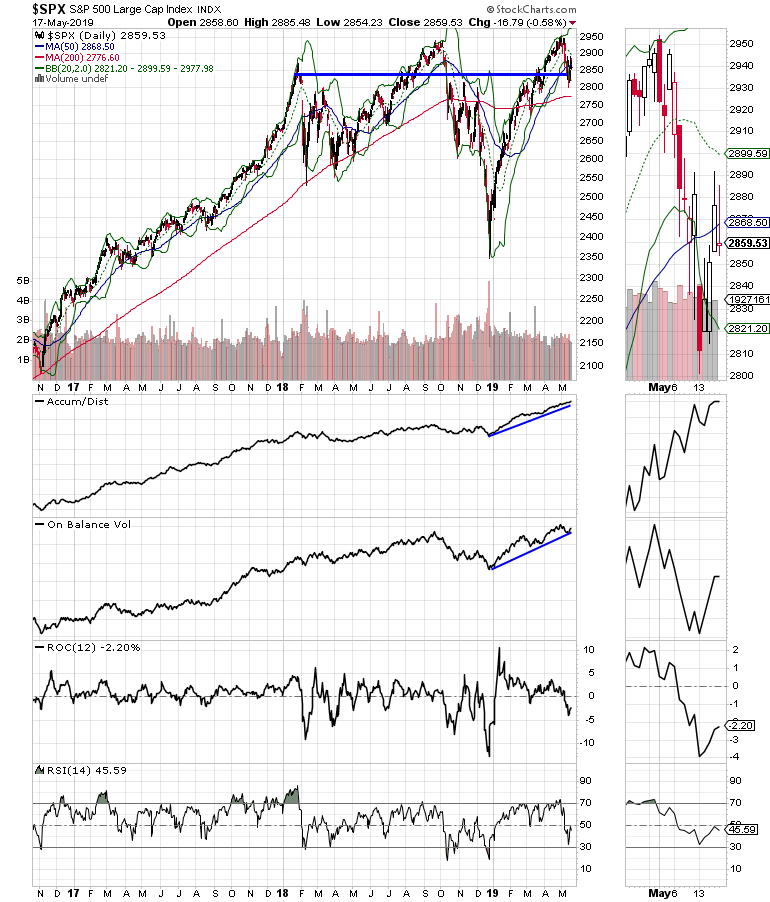

The S&P 500 (SPX) closed below its 50-day moving average, which is negative, but is something that could be easily reversed. Accumulation-Distribution (ADI) and On Balance Volume (OBV) remain in up trends and ROC is just below the zero line with RSI just below 50.

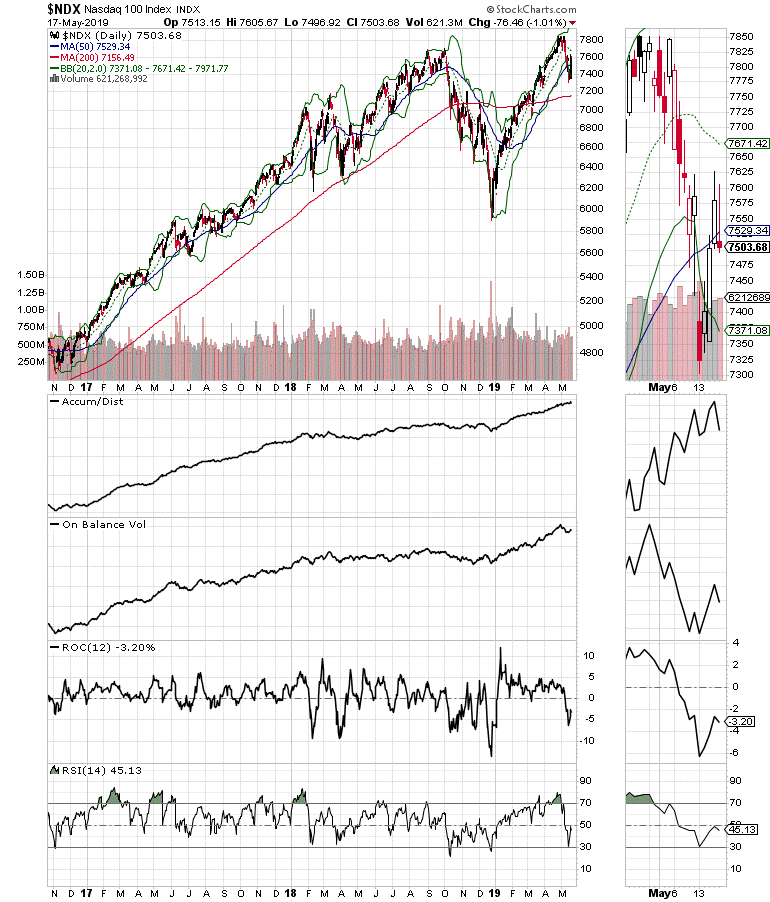

The Nasdaq 100 (NDX) ended in a similar technical posture. When all the indicators are summarized, you still have nothing concrete other than the market could go lower, but that it may not unless the headlines are seen as being negative by the algos.

Patience, Stock Picking, and Hedging

This is a challenging market to trade due to the headlines and the algos. Investors who stick with the basics should be able to weather the storm. But for now, it makes sense to avoid algo stocks, such as big tech and multinationals for now. Instead, focus on out of the way, less actively traded stocks with good management and attractive business lines. Otherwise, with the summer trading season about to kick off, maybe an early vacation is not a bad idea.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Investing in your 20s and 30s and six other trading books.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit joeduarteinthemoneyoptions.com.