The Russell 2000 is nearing a critical 617 weeks from 2007 high, which could signal a reversal, warns Jeff Greenblatt.

As you know equity markets sold off hard in May but responded well in June. They came to the seasonal change point in June, started to change direction but hit another window, the 127-day window off the bottom on June 27. We’ve covered the fact they turned up again.

Consequently, I haven’t paid too much attention to larger cycles yet, until last Friday. What happened last Friday was a change in the wind. The jobs number was very good yet the initial kneejerk reaction was to sell. Yes, there was an interesting Kairos reading on Friday morning that allowed the market to turn back up but it couldn’t sustain when traders came back from the holiday break. When the near-term picture gets cloudy, it’s time to look at bigger picture.

As you know, the Fed Funds Futures projected a 100% probability of a rate cut in July. The rate cut was already priced in. What happens if there is no rate cut? Markets and do start selling. Suddenly the crowd saw the distinct possibility there might not be a cut. In healthy bull markets, markets go up on good news. In other markets, the reaction to good news is different. This one was different. So, is it late stage bull or early stage bear? It doesn’t matter, it was no longer typical bull behavior (though in fairness, the good news is bad/bad news is good reaction based on the Fed’s reaction has been the rule, not the exception over the last decade).

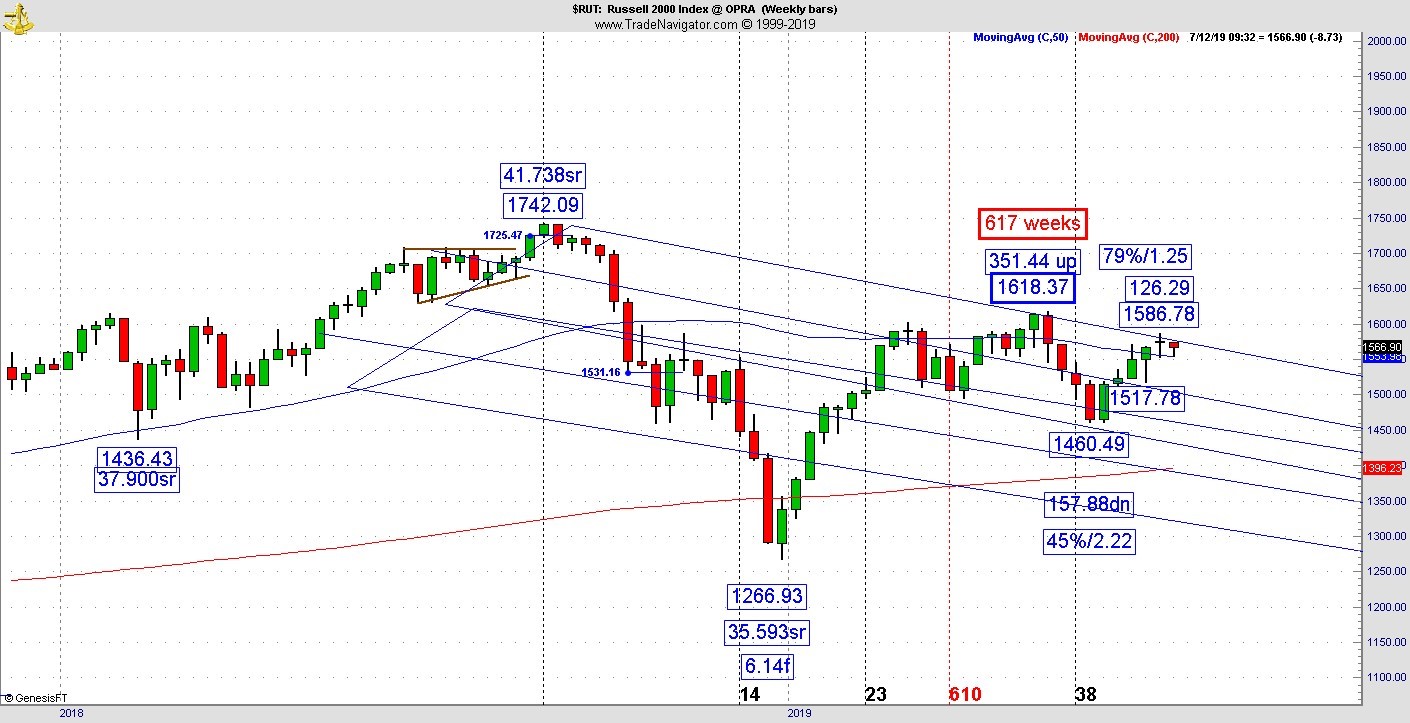

You’ll never see a prettier chart than this Russell 2000 top which is incredibly complex (see chart below). The high in early May is 1618.37. By itself, that’s incredibly interesting because it’s a perfect golden spiral number. Many times, these pivots are taken out, sometimes they become long-term monuments to completed bull markets. This one turned out to be neither top nor bottom. So why are we looking at it? Simply put, its 617 weeks from its top in 2007. Suddenly, as the action approaches this golden spiral vibrational pivot, its starting to weaken. Should the market turn down from here, this could be the pivot point to remember. But it may or may not because there are going to be other important time windows stretching out through the rest of the summer.

What I can tell you from 20 years of doing this work, is markets will usually have several time windows to a season. The first few work as speedbumps to the rally and finally when everyone gives up on the possibility the market could rollover, it finally does. Markets usually stretch our emotions beyond elasticity. In terms of a bull, everyone gets completely euphoric to the point the only direction could be up, that’s when it happens. The late Mark Haines called the bottom of the financial crash leg at the point the other shoe dropped again and nobody thought the market could ever come back up. Within a couple of hours, shorts were covering and markets were suddenly going through the roof.

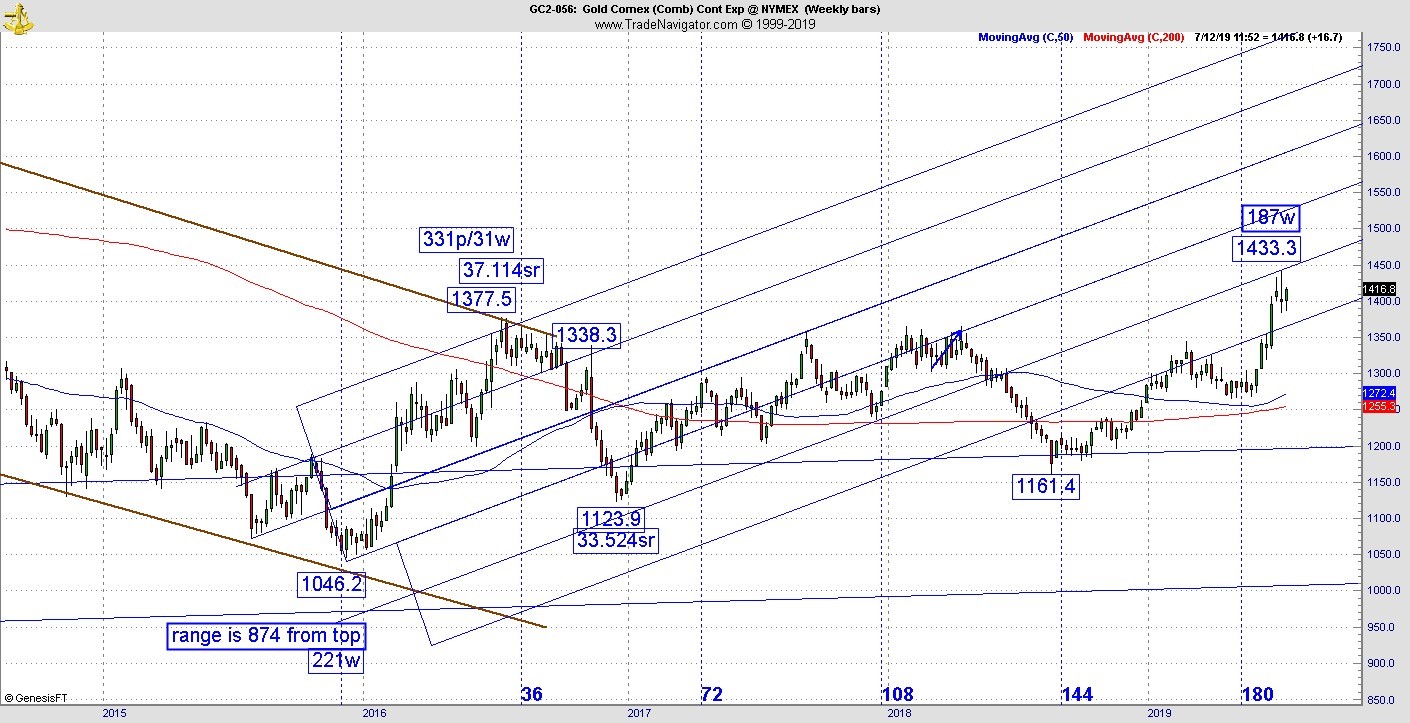

We could be in for a whole summer of this. Elsewhere, I warned gold could be in for a rough ride as it encountered a longer term reading on the weekly chart (see chart below). Its been a rough two weeks and on the weekly it left that upper tail. The bottom line as they come out of this sequence, if it turns up higher out of the 87 vibrational window odds go way up for a major bull move. Some pundits are calling for $2,000 by the end of the year. That’s counterproductive at this point because they aren’t seeing $1,600, no less $2,000 if this cycle point isn’t taken out. The great thing about Kairos work is it puts the cart before the horse and allows a trader to go one step at a time. Right now, precious metals are behaving better. It could be a lot worse.

Will there be a rate cut in July? To some people, that’s incredibly important. To traders, the key question ought to be what the reaction will be whether there is or not. Equally important will be whether the Russell 2000 will take out that high or whether it will start to lead to the downside. Chances are if the Russell turns down, the bigger vibration in precious metals will be taken out to the upside. A few key readings can leverage our view of the larger picture for all the financial markets.