The Treasury complex is showing a divergence from the short end to the long end, writes Andy Waldock.

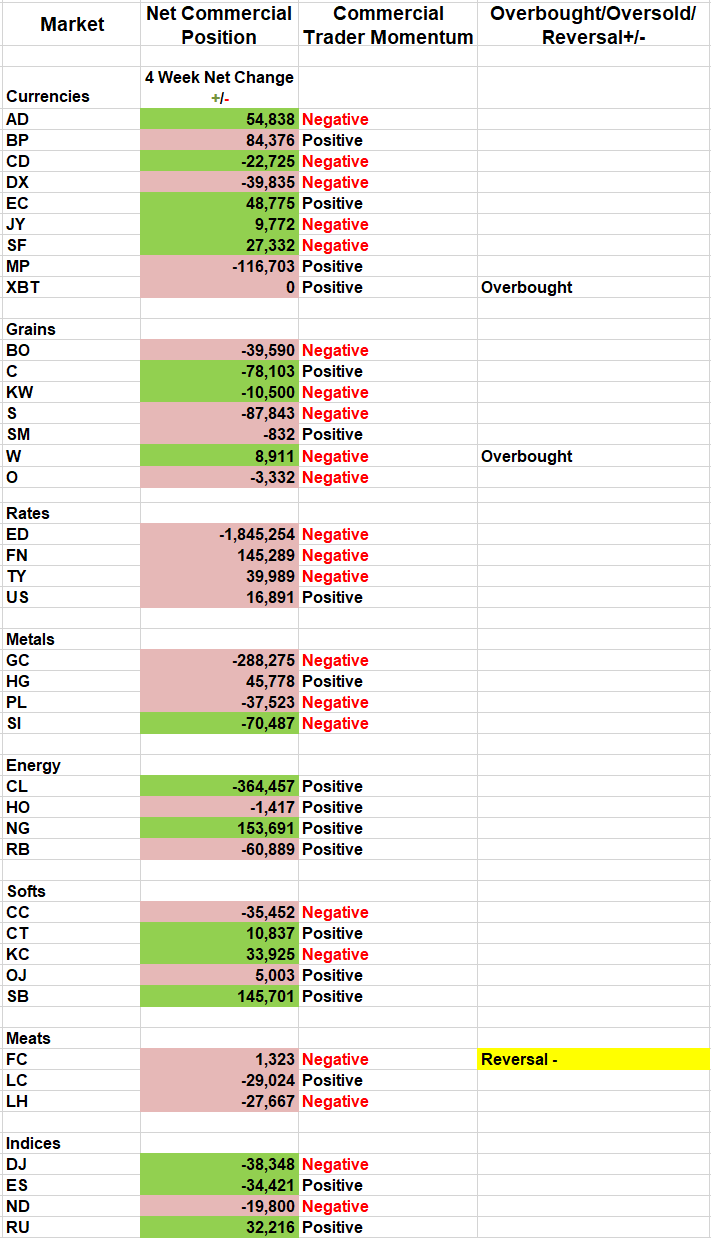

We have a few things to discuss this week so, we’ll get right to it, beginning with the interest rates. We’ve been tracking the deflationary theme for several weeks now, and the commercial traders see no reason for this to change. We do see a subtle, but tradable, shift forming within the interest rate futures complex.

The recent spikes at the short end of the yield curve are creating significant bearish divergences in the two-year, five-year and 10-year Treasury notes. Meanwhile, the 30-year Treasury bonds, while sharing a roughly similar pattern, are not being pressured on the sell side by the commercial traders. The takeaway is that interest rates are compressing. If the December five-year T-note closes below 118-23 this coming week, it will set off a run lower in prices and higher in yields as the market resets itself. The next couple of weeks should be fascinating in the interest rate sector as we head into the final Federal Open Markets Committee (FOMC) meeting on Dec. 10-11.

How will this play out in the forex markets? Well, we’re not sure. Rather than guess, we’ll follow the commercial traders’ lead and the methodology that got us long the euro and short the U.S. Dollar Index heading into last week. Our weekly COT Signals not only nailed the reversal but also covered the short Swiss franc position at a profit ahead of the turnaround.

Open Positions:

- Lower the protective buy stop in the U.S. Dollar Index to 98.37 and look for support (profits) around 94.50.

- Raise the protective sell stop in the euro currency to 1.0992 and look for resistance (profits) around 1.15.

Shifting to the agricultural markets, the live cattle trade continues to work in our favor. Raise the December live cattle protective sell stop to $112. Raising the stop will lock in about 10 points or more than $4k per contract.

Soybean Trade

Finally, we took profits on our seasonal soybean trade last week. Soybeans climbed nearly 5% since our entry on Oct. 1, and we made a nice profit. However, over the previous two weeks, I became increasingly anxious, holding our long position in the face of increasingly significant short hedging as this crop has been harvested.

The commercial traders’ net position grew more bearish by 50k contracts as we held our seasonal long position. Now, the commercial traders are selling with both hands. We have some quantitative qualifications that we use to determine how anxious the biggest traders are to execute their businesses’ needs at a given market price. Commercial traders’ selling last week was more than two standard deviations above their anticipated activity and set a new net short rolling 52-week low. That’s anxious, and we think this caps the November contract under $9.50.

Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.