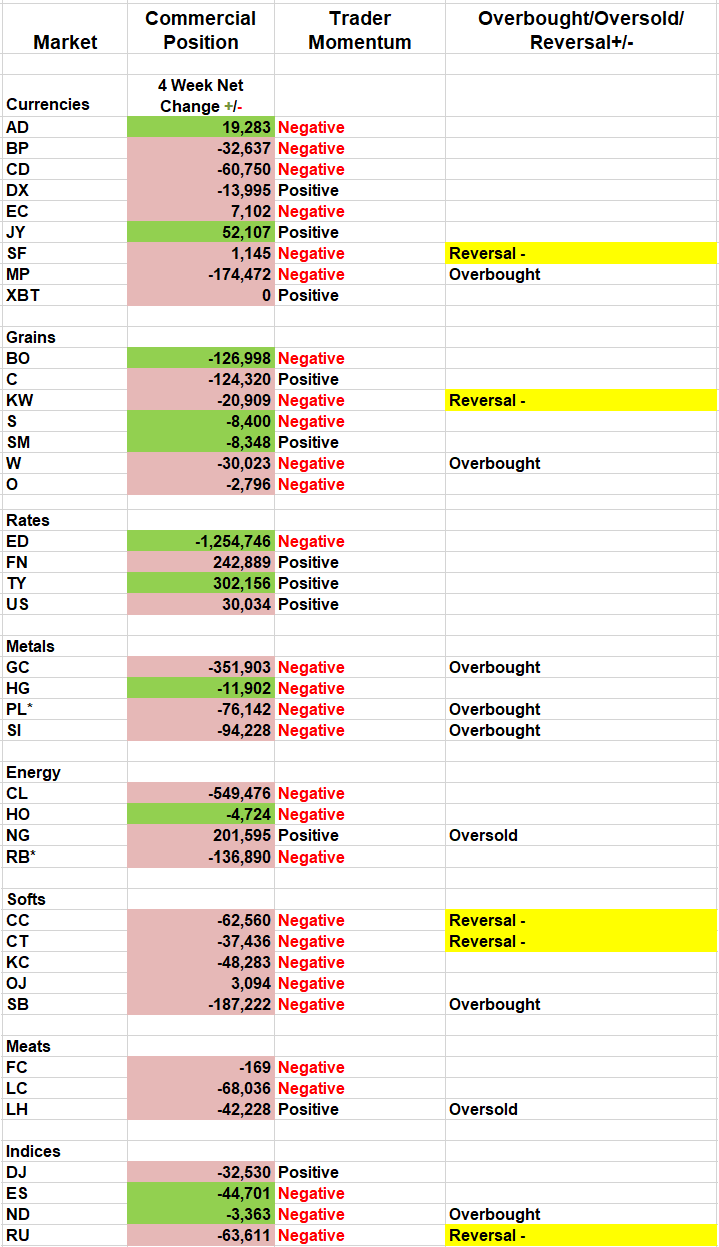

This week COT report suggests numerous downward reversals are in play and continued weakness int eh energy sector, notes Andy Waldock.

The markets seem to be acting in a somewhat typical fashion, once again. There’s always another trade. Therefore, there’s no reason to be in markets that aren’t producing and fulfilling, precise setups. That said, we’ll review the open trades from the last two weeks and look at pending reversals for the week ahead.

Two weeks ago, we recommended a short position in the March Canadian dollar. Watch the trend line rising from the May low, which now comes in at $.7565. A close below here reveals the next trend line support level from the December low, currently at $.7445.

This week, we’re looking for a reversal lower in the Swiss Franc.

We recommended a soybean oil short sale based upon statistically significant commercial selling, which set a new net short total three weeks in a row and was more than two standard deviations beyond their usual level of activity for the period (see table below). These factors conspired to drive soybean oil prices more than 8% lower over the last two weeks. This is exactly the type of move our Commitment of Traders (COT) analysis is intended to reveal. The long-term moving averages now come in between Friday’s close on the high side and 30.81 on the low side. Look for profits accordingly.

This week, we have a similar short sale reversal set up in the Kansas City wheat. Commercial traders have been aggressive sellers for the last four weeks. Additionally, last week’s selling drove their net position to a 52-week low (see table).

Energy Sector

Shifting to the energy complex, we sold short unleaded, and heating oil while buying natural gas. Our loss in natural gas limited to the swing low at $2.062, well above our current prices. Fortunately, our unleaded and heating oil positions were large winners. Protective buy stops should be lowered to last week’s highs at a minimum.

Watch crude oil. Crude closed right on the upward sloping weekly trend line from the December low. This is the third test, and a failure could wash out the speculative bid, driving prices towards $50 per barrel.

View past letters on our site for free. Subscribe to follow along and receive stop levels plus additional commentary. Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.