Adding protective puts to create a collar is a good way to protect against catastrophic losses in covered call trades, writes Alan Ellman.

Covered call exit strategies play a major role in mitigating losses in our BCI methodology. In most cases, we can keep losses to a minimum, turn losses into gains and enhance profits as well. Some covered call writers want the security of protecting against a rare but catastrophic gap-down move. With the current market volatility caused by the Coronavirus crisis, I felt this would be an appropriate topic to discuss.

One way to accomplish this is by purchasing a protective put in what is known as the collar strategy. Here’s how it works:

The collar strategy

- Buy a stock

- Sell an out-of-the-money call (strike higher than current market value)

- Buy an out-of-the-money put (strike lower than current market value)

Goals of this strategy

- Generate cash flow

- Protect against catastrophic price decline in the underlying security (advantage)

Disadvantages

- Lower returns

- Higher cost & complexity (Managing three positions instead of two)

Here is a recent example in Commercial Metals Company (CMC)

Here we will calculate the hypothetical returns using no puts (initial calculations using The Ellman Calculator) in one case and evaluating three different strike prices for implementing the collar strategy with protective puts (using the BCI Collar Calculator). I am using Commercial metals Company in this example as it has been appearing on our premium watch list in December 2019, has decent returns and several choices of strikes. Here are the stats at the time I am writing this article:

CMC Stats on Dec. 31, 2019

Price = $22.33

Call strike selected = $23

Put strikes to evaluate = $18.00, $19.00 and $20.00

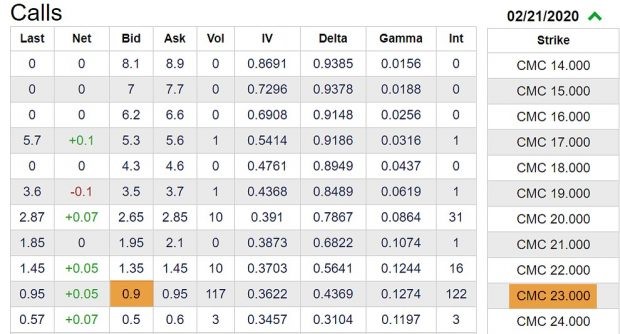

CMC call option-chain for Dec. 31, 2019 below

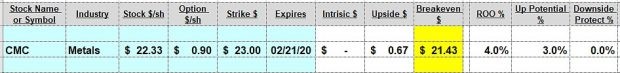

CMC Initial Calculations using as of Dec. 1, 2019

CMC: Initial Time-Value Return Calculations

* 4.0%, seven-week return

* 3.0% upside potential from current market value to the $23.00 strike

* 7% potential seven-week return

* 52% maximum potential annualized return

CMC put option-chain for Dec. 31, 2019

CMC Collar Calculations using The BCI Collar Calculator as of Dec. 31

Initial returns range from 1.79% to 3.13% or 12.57% to 22.00% annualized. If share price moves above the $23.00 call strike, maximum initial returns run from 4.79% to 6.14%. If share price declines below the put strike, losses range from 8.64% to 16.26%.

Discussion

The initial return not using protective puts is significantly higher than when including them (see ROO column). If the share price closes above the call strike price (>call strike column), not buying a put produces the best results (7%).

If the share price closes below the put strike, the smallest losses occur for the higher strike puts but all still result in losses. Position management can also be used in the collar strategy but is more involved and may require more time because the investor is in 3, rather than 2, positions.

Commentary

Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. However, it does have its advantages and disadvantages. The main advantage is that the call writer is protected against catastrophic share depreciation below the put strike. This is especially beneficial in volatile markets like we are experiencing now.

The main disadvantage is that the initial profits generated from the sale of the call will be substantially lower due to the debit resulting from the purchase of the put. The main reason for a stock price gap-down is a disappointing earnings report and we avoid those situations in our BCI methodology.

However, unexpected bad news can come out at any time—or during any period in a news cycle. For instance, the Coronavirus spread had been in the public for several weeks and the market basically sloughed it off. It was only when a spike in cases in Italy and Iran occurred that the market reacted.

Although that scenario is rare, some investors may prefer the protection afforded by protective puts. There is no right or wrong here. Each investor must make his (her) own determinations. I personally do not buy puts but have absolutely no problem with members who do. In extreme markets as we are currently experiencing moving to cash and using inverse exchange traded funds (ETFs) can also play useful roles.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here .I'll be presenting a free, one-hour webinar for the Options Industry Council on Wednesday May 8 at 3:30 p.m. CST, entitled, Covered Call Writing: Basics and Practical Application. The event is open to all. Just follow the link above to register.

Even if you feel you may not be able to attend the live presentation, sign up and receive a recording to review at your leisure.